Kennedy Wilson, Beverly Hills, Calif., acquired 344-unit apartment community Sombra del Oso in Albuquerque, N.M. for $65 million.

Category: News and Trends

Quote

“The sharp rebound in the economy, as well as a potent combination of government fiscal and regulatory help, is fueling unprecedented demand for residential housing and enabling people to buy and stay in their homes. The drop in delinquency rates is a further manifestation of the benefits of these tail winds.”

–Frank Martell, president and CEO of CoreLogic.

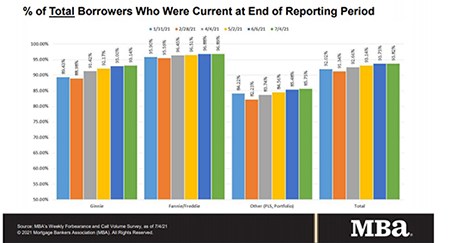

Share of Mortgage Loans in Forbearance Decreases to 3.76%

The Mortgage Bankers Association’s latest Forbearance and Call Volume Survey reported loans now in forbearance decreased by 11 basis points to 3.76% of servicers’ portfolio volume as of July 4 from 3.87% the week before,–the 19th consecutive weekly decline. MBA estimates 1.9 million homeowners are in forbearance plans.

Industry Briefs July 14, 2021

FormFree, Athens, Ga., partnered with ICE Mortgage Technology, part of Intercontinental Exchange Inc., a provider of data, technology and market infrastructure, to make its AccountChek 3n1 asset, income and employment verification service available in the Encompass cloud-based loan origination platform

Louis Zitting: Are You Giving Your Old Contacts a Fresh Look?

The reality is that most loan officers with a good-sized database have plenty of contacts who are ready to finance or refinance right now—they just don’t know who they are. But there are ways to identify them and turn a missed opportunity into a success story.

Sponsored Content from SWBC: Improve the LPI Borrower Experience by Leveraging Innovative Technology

In this article, we’ll discuss how EDI and RPA technologies help lenders streamline insurance tracking and verification and reduce direct member contact.

Call for Speakers: MBA Annual Convention & Expo; Deadline July 16

Speaking proposals for breakout sessions are now being accepted for the Mortgage Bankers Association’s Annual Convention & Expo 2021, taking place October 17-20 at the San Diego Convention Center.

Jennifer Henry: The Role Third-Party Data Plays for Mortgage Originators and Servicers

Lenders and servicers alike must focus on streamlining processes through automated technology and data-enabled solutions to sustain a more profitable business model and manage the shifts and demands of the marketplace.

Paradatec’s Neil Fraser: For Servicers, Pandemic-Related Challenges Are Just Beginning

Neil Fraser is Director of U.S. Operations for Paradatec, Cincinnati, Ohio, a provider of AI-based document classification and data extraction technology for mortgage loan processing. He manages all of Paradatec’s operations and has grown the company every year since its incorporation in 2002.

Authors Malcolm Gladwell, Brad Meltzer Keynote MBA Annual Convention & Expo

Registration for the Mortgage Bankers Association’s Annual Convention & Expo, taking place Oct. 17-20 at the San Diego Convention Center, is officially open. Join MBA in San Diego as New York Times best-selling authors Malcolm Gladwell and Brad Meltzer keynote General Sessions on Tuesday, Oct. 19.