Sponsored Content from SWBC: Improve the LPI Borrower Experience by Leveraging Innovative Technology

John Blair is Executive Vice President of National Sales for The Financial Institution Group at SWBC, San Antonio, Texas. He joined SWBC in 2013 has more than 16 years of sales and sales leadership experience in the mortgage market, including roles at QBE Insurance and Balboa Insurance Group. He has a Bachelor of Arts degree in political science from the University of Iowa.

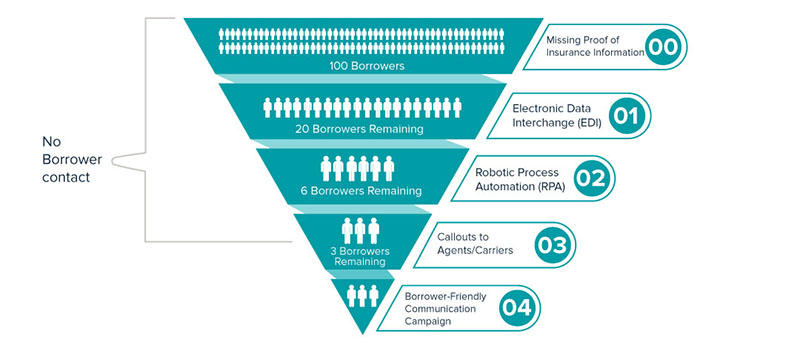

Confirming your borrowers have current homeowners insurance has historically been a pain point for mortgage servicers. Typically, you put time and effort into multiple letters and callouts, only to discover that your borrower actually has insurance in place — which only results in you irritating your borrowers. Fortunately, with the benefits of electronic data interchange (EDI) and robotic processing automation (RPA) technology, it’s possible to confirm insurance coverage for a very high percentage of borrowers without contacting them at all.

Lenders’ service providers can leverage EDI technology to efficiently track and process loan data against borrowers’ insurance information to identify customers whose homeowners insurance policies have lapsed or may be in danger of lapsing. Delegating this process to a computer system can enhance accuracy by eliminating human errors that often occur with data-entry. It also significantly speeds up the process of verifying your borrowers’ insurance status.

For a majority of the policies that can’t be confirmed with EDI, RPA technology gathers current policy information from carrier websites. Combining these two technology processes with a callout program to insurance agents and carriers reduces the need to contact your borrowers to a very small percentage of your portfolio.

It’s important that your borrowers who receive LPI-related communication have policies that are truly no longer in place or in actual danger of lapsing. In this article, we’ll discuss how these technologies help lenders streamline insurance tracking and verification and reduce direct member contact.

Leveraging Electronic Data Interchange Technology

According to AcrESB, “Electronic Data Interchange (EDI) is the automated, computer-to-computer exchange of standard electronic business documents between business partners over a secure, standardized connection.”

Looking up insurance information and comparing documents from different sources is a very time-consuming (and dull) task for a service member to complete. Lenders can leverage EDI technology to efficiently track and process loan data against their borrowers’ insurance information to identify customers’ whose homeowners insurance policies have lapsed or may be in danger of lapsing.

Delegating this process to a computer system can enhance accuracy by eliminating human errors that often occur with data-entry. It also significantly speeds up the process of verifying your borrowers’ insurance status.

Leveraging Robotic Processing Automation Technology

According to CIO, “RPA is an application of technology, governed by business logic and structured inputs, aimed at automating business processes. Using RPA tools, a company can configure software, or a ‘robot,’ to capture and interpret applications for processing a transaction, manipulating data, triggering responses and communicating with other digital systems.”

RPA bots can capture and analyze data very quickly. They can also perform automated tasks and execute data-based logic effectively and efficiently. Bots are capable of interpreting information, integrating with other systems, and responding to multi-step commands that enable them to carry out essential functions that humans would take longer to execute.

Situations in which a company might leverage RPA can range from the relatively simple task of sending an automatic email response to creating a system of thousands of bots to perform a complex series of automated jobs.

Lenders can employ RPA technology to help them quickly identify any potential gaps in their borrowers’ homeowners insurance coverage.

Leveraging Tactful Communication with Borrowers

Although EDI and RPA technology can drastically reduce the need for direct borrower contact about lender-placed insurance, there will still be some instances in which you need to reach out to your borrower. Communicating empathetically with your borrowers whose insurance has lapsed is key to reducing escalations.

For borrowers who need to be contacted directly, SWBC offers omnichannel communication options via email, text, interactive voice response (IVR), or live calls so your borrowers can communicate at their convenience with minimal effort.

For more information about how SWBC can help your institution increase efficiency and improve borrower communication for your LPI process, visit our website.

(Sponsored content includes material submitted independently of the Mortgage Bankers Association and MBA NewsLink and does not connote an MBA endorsement of a specific company, product or service. For more information about sponsored content opportunities, contact Bill Farmakis at bill@jlfarmakis.com or 203/834-8832.)