Net-lease investment brokerage firm The Boulder Group, Wilmette, Ill., closed nearly $50 million in property sales in Illinois and Ohio.

Category: News and Trends

Builder Confidence Edges Lower as Material Challenges Persist

Strong buyer demand partially offset building material supply-side challenges, regulation and labor as builder confidence in the market for newly built single-family homes inched down one point to 80 in July, the National Association of Home Builders/Wells Fargo Housing Market Index reported.

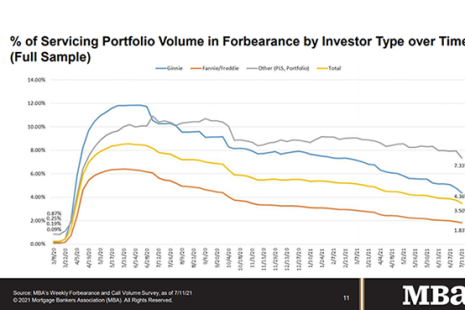

Share of Mortgage Loans in Forbearance Decreases to 3.50%

The Mortgage Bankers Association’s latest Forbearance and Call Volume Survey reported loans now in forbearance decreased by 26 basis points to 3.50% of servicers’ portfolio volume as of July 11–the twentieth consecutive weekly decline.

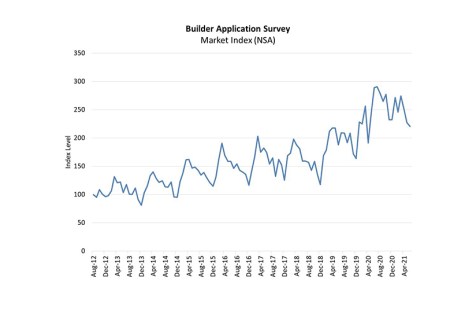

June New Home Purchase Mortgage Applications Decreased 23.8% Y-o-Y

Mortgage applications for new home purchases decreased 23.8 percent compared to a year ago, the Mortgage Bankers Association’s Builder Application Survey data said.

MBA Weekly Applications Survey July 21, 2021: Apps Decrease

Mortgage applications decreased 4.0 percent from one week earlier, the Mortgage Bankers Association reported in its Weekly Applications Survey for the week ending July 16. The previous week’s results included an adjustment for the Fourth of July holiday.

MISMO RON-Certified Platforms Increase 40%

MISMO®, the real estate finance industry’s standards organization, announced that 14 technology platforms have now successfully completed MISMO Remote Online Notarization (RON) certification.

Quote

“Homebuilders are encountering stronger headwinds of late as severe price increases for key building materials, rising regulatory costs and labor shortages impact their ability to raise production. This has dampened new home sales and quickened home-price growth.”

–Joel Kan, MBA Associate Vice President of Economic and Industry Forecasting.

MBA Advocacy Update July 19, 2021

Last Friday, FHFA announced the removal of the GSEs’ 50-basis-point adverse market fee in response to both industry advocacy and improved market conditions.

Housing Market Expected to Remain Strong Despite Supply, Price Concerns

The low mortgage rates that have supported the housing market throughout the pandemic will likely increase later this year, but just gradually, said Freddie Mac, McLean, Va.

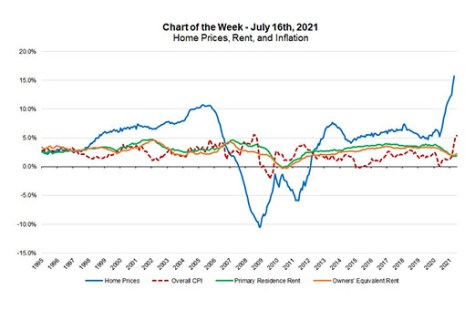

MBA Chart of the Week, July 19, 2021: Home Prices, Rent and Inflation

Federal Reserve Chair Jay Powell testified before Congress last week and received several questions regarding recent inflation trends, with overall CPI inflation increasing 5.4 percent in June 2021 compared to a year ago. This followed readings of 4.2 percent in April and 5.0 percent in May. The headline inflation number was the highest in 13 years, while the recent monthly pace of core inflation is the highest since the early 1980s.