NotaryCam, Newport Beach, Calif., partnered with RUTH RUHL P.C., a Texas-based law firm, to add security and automation to the firm’s loss mitigation services through remote online notarization.

Category: News and Trends

Authors Malcolm Gladwell, Brad Meltzer Keynote MBA Annual Convention & Expo

Registration for the Mortgage Bankers Association’s Annual Convention & Expo, taking place Oct. 17-20 at the San Diego Convention Center, is officially open. Join MBA in San Diego as New York Times best-selling authors Malcolm Gladwell and Brad Meltzer keynote General Sessions on Tuesday, Oct. 19.

Quote

“Sellers appear to be more confident about finding another home after they sell their current one. If these trends continue, inventory levels should keep growing.”

–RE/MAX President Nick Bailey.

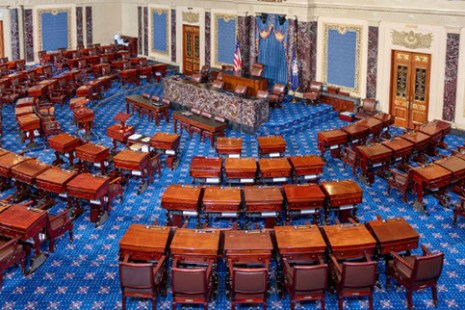

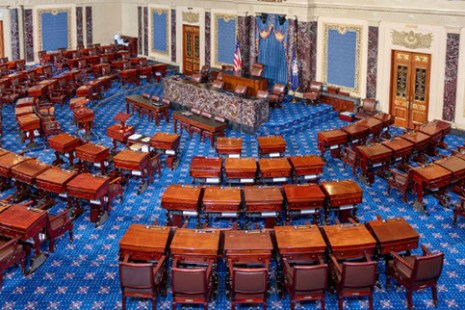

MBA, Trade Groups Reiterate Opposition to G-Fee Offsets

Fresh off of last week’s regulatory victory in which the Federal Housing Finance Agency withdrew its controversial adverse market refinance fee, the Mortgage Bankers Association and several dozen industry trade groups took fresh aim at another controversial practice—a move in Congress to use the government-sponsored enterprises’ guaranty fees—known as “g-fees”—to offset funding for non-housing programs.

MBA, Trade Groups Urge HUD to Address FHA Affordable Housing Delays

The Mortgage Bankers Association and a dozen industry trade groups urged HUD to address “severe processing delays” that are impeding financing of affordable housing in the Federal Housing Administration multifamily and healthcare programs.

Mark P. Dangelo: The Dark Matter Transforming M&A Post-Deal Landscapes, Part 1

Industry 4.0 for banking and financial services is changing the landscape of the who, what, where, why, and how of M&A targets and post-deal actions. Prescriptions are out—a new framework is in due to non-stop deals, vast data, and layers upon layers of new innovations. M&A actions moving forward are all about “Are we asking the right questions?”

MBA Seeks Participants in New Diversity, Equity and Inclusion Study

The Mortgage Bankers Association introduces a new offering to its members — the Diversity, Equity and Inclusion (DEI) Study — separately designed and compiled for both the residential and commercial/multifamily sides of the real estate finance industry

MBA Launches CONVERGENCE: Columbus

The Mortgage Bankers Association this week launched a major pilot program to promote minority homeownership opportunities in Columbus, Ohio.

MBA, Trade Groups Reiterate Opposition to G-Fee Offsets

Fresh off of last week’s regulatory victory in which the Federal Housing Finance Agency withdrew its controversial adverse market refinance fee, the Mortgage Bankers Association and several dozen industry trade groups took fresh aim at another controversial practice—a move in Congress to use the government-sponsored enterprises’ guaranty fees—known as “g-fees”—to offset funding for non-housing programs.

Black Knight: 1.55 Million Serious Delinquencies Nag Market

Black Knight, Jacksonville, Fla., said the national delinquency rate hit its lowest level since the onset of the pandemic in June and is now back below its pre-Great Recession average. Despite the improvement, more than 1.5 million homeowners remain 90 or more days past due on their mortgages but who are not in foreclosure, still nearly four times pre-pandemic levels.