Redfin, Seattle, reported luxury home prices soared 26 percent year-over-year in the second quarter, while prices of the most affordable homes grew 19 percent. Both segments outpaced the rest of the market.

Category: News and Trends

Seth Appleton: How MISMO Standards Are Helping The Industry Achieve Higher Tech Adoption

At the recently concluded MISMO Spring Summit–which set an attendance record for the organization–two related themes emerged during many of the event’s “Going Digital” sessions. Experts throughout the four-day event agreed that technology adoption and data trust are two business challenges that must be solved so the industry can truly “go digital” and realize the benefits that come along with it.

Dealmaker: Meridian Capital Group Arranges $103M in Construction Takeout Financing

Meridian Capital Group, New York, arranged $103 million in construction takeout financing for The Pointe on Westshore, a multifamily property in Tampa, Fla.

MISMO’s Jan Davis Receives HousingWire Woman of Influence Award

MISMO®, the real estate finance industry’s standards organization, announced Vice President of Operations Jan Davis received a HousingWire 2021 Woman of Influence award.

Global Commercial Real Estate Brokerage, Management Market Could Reach $424B by 2030

Allied Market Research, Portland, Ore., said the global commercial real estate brokerage and management market generated $209 billion in 2020 and could reach $424 billion by 2030.

FHFA Encourages Landlords to Apply for Emergency Rental Assistance Before Evicting Tenants

The Centers for Disease Control’s eviction moratorium expired July 31, but the Department of Agriculture, HUD, the Department of Veterans Affairs and the Federal Housing Finance Agency extended their foreclosure-related eviction moratoria until September 30. The agencies issued a joint statement encouraging landlords of properties backed by Fannie Mae or Freddie Mac to apply for Emergency Rental Assistance before starting the eviction process for non-payment of rent.

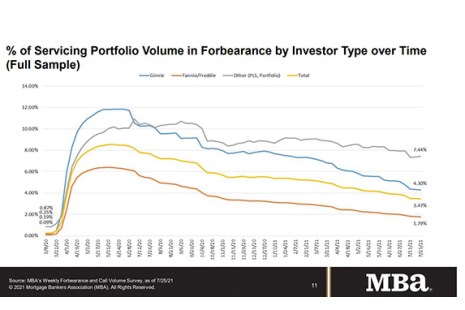

Share of Mortgage Loans in Forbearance Slightly Decreases

Loans in forbearance fell for the twenty-second consecutive week, the Mortgage Bankers Association said on Monday.

FHFA Encourages Landlords to Apply for Emergency Rental Assistance Before Evicting Tenants

The Centers for Disease Control’s eviction moratorium expired July 31, but the Department of Agriculture, HUD, the Department of Veterans Affairs and the Federal Housing Finance Agency have extended their foreclosure-related eviction moratoria until September 30. The agencies issued a joint statement Friday encouraging landlords of properties backed by Fannie Mae or Freddie Mac to apply for Emergency Rental Assistance before starting the process of evicting a tenant for non-payment of rent.

Paul Anselmo of Evolve Mortgage Services: Defragmenting the Digital Closing Process

Paul Anselmo is CEO and founder of Evolve Mortgage Services, Frisco, Texas, a provider of outsourced mortgage platforms. He has more than 30 years of experience in the banking and mortgage industries. Previously he served as president, CEO and founder of Mortgage Resource Network (MRN), a business process outsourcer and technology provider to the mortgage industry. In 2019, he was honored as a “Lending Luminary” by the PROGRESS in Lending Association.

Fitch Ratings: Environmental Factors Can Affect CMBS Large Loan Ratings

Fitch Ratings, New York, said a property’s environmental impact and sustainability may influence commercial mortgage-backed securities bond ratings in single-asset single-borrower and large-loan transactions.