The Consumer Financial Protection Bureau published an issue brief showing consumer applications for auto loans, new mortgages and revolving credit cards had mostly returned to pre-pandemic levels by May.

Category: News and Trends

MBA: GSE Compensation Should be Sufficient to Attract Best Talent

The most important asset Fannie Mae, Freddie Mac and the Federal Home Loan Banks have is their human capital, so their compensation must be sufficient to attract and retain top talent, the Mortgage Bankers Association said in a letter to the Federal Housing Finance Agency Tuesday.

ATTOM: Home Profits Take Unusual 2Q Dip

ATTOM, Irvine, Calif., said profit margins for home sellers took an unusual dip in the second quarter but still were far above where were they were a year earlier.

MBA RIHA: Fewer Households Missed Housing Payments in Second Quarter

Slightly under five million households did not make their rent or mortgage payments in the second quarter, updated research from the Mortgage Bankers Association’s Research Institute for Housing America reported.

MBA Weekly Applications Survey Aug. 4, 2021: Applications Decrease

Mortgage applications decreased 1.7% from the week before, the Mortgage Bankers Association reported in its Weekly Mortgage Applications Survey for the week ending July 30, 2021.

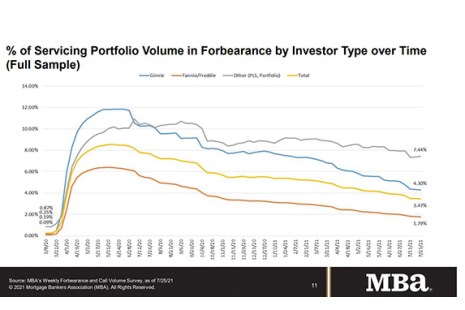

Share of Mortgage Loans in Forbearance Slightly Decreases

Loans in forbearance fell for the twenty-second consecutive week, the Mortgage Bankers Association said on Monday.

MISMO’s Jan Davis Receives HousingWire Woman of Influence Award

MISMO®, the real estate finance industry’s standards organization, announced Vice President of Operations Jan Davis received a HousingWire 2021 Woman of Influence award.

Fitch Ratings: Environmental Factors Can Affect CMBS Large Loan Ratings

Fitch Ratings, New York, said a property’s environmental impact and sustainability may influence commercial mortgage-backed securities bond ratings in single-asset single-borrower and large-loan transactions.

Quote

“The greatest asset [Fannie Mae, Freddie Mac and the Federal Home Loan Banks] have is their human capital, so executive compensation must be set at a level sufficient to attract and retain top-level talent. It also is critical that compensation programs, and in particular incentive structures within these programs, foster competitive, liquid, efficient and resilient national housing finance markets while affirmatively promoting safety and soundness objectives.”

–MBA President and CEO Robert Broeksmit, CMB.

Paul Anselmo of Evolve Mortgage Services: Defragmenting the Digital Closing Process

Paul Anselmo is CEO and founder of Evolve Mortgage Services, Frisco, Texas, a provider of outsourced mortgage platforms. He has more than 30 years of experience in the banking and mortgage industries. Previously he served as president, CEO and founder of Mortgage Resource Network (MRN), a business process outsourcer and technology provider to the mortgage industry. In 2019, he was honored as a “Lending Luminary” by the PROGRESS in Lending Association.