Commercial and multifamily mortgage bankers are expected to close $578 billion in loans backed by income-producing properties in 2021, a 31 percent increase from 2020’s volume of $442 billion, according to a new forecast released Tuesday by the Mortgage Bankers Association.

Category: News and Trends

Dealmaker: JLL Arranges $422M for Atlanta Piedmont Center

JLL, Chicago, arranged $421.8 million for Piedmont Center, a 14-building, 2.2 million-square-foot Class A Atlanta office complex.

Andrew Foster: Multifamily Values Amid a Shifting Landscape

The summer has brought big news for the housing industry including but not limited to multifamily market participants.

MBA Shares Concerns with Ginnie Mae on Eligibility Requirements for Single-Family MBS Issuers

The Mortgage Bankers Association shared recommendations and concerns with Ginnie Mae regarding proposed changes to eligibility requirements for single-family mortgage-backed security issuers.

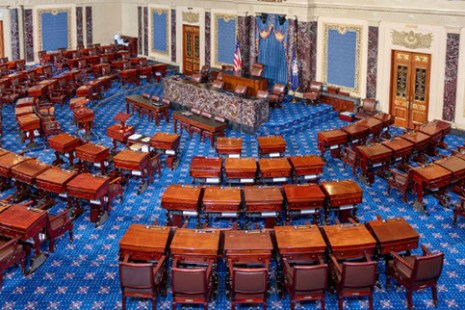

MBA, Trade Groups Oppose Amendment Altering False Claims Act

As the Senate plods toward what appears to be eventual passage of a massive infrastructure framework, the Mortgage Bankers Association and several other industry trade groups expressed opposition to an amendment that would unfavorably alter the False Claims Act.

Omaha Chamber of Commerce Inducts Rodrigo López, CMB, into Hall of Fame

The Greater Omaha Chamber of Commerce will induct former Mortgage Bankers Association Chairman Rodrigo López, CMB, into its Omaha Business Hall of Fame in a ceremony later this month.

Rita Moreno Keynotes mPower Luncheon at MBA Annual Convention & Expo

Registration for the Mortgage Bankers Association’s Annual Convention & Expo, taking place Oct. 17-20 at the San Diego Convention Center, is officially open. Join MBA in San Diego as Academy Award- and Presidential Medal of Freedom Award-winning actress Rita Moreno keynotes the mPower Luncheon on Tuesday, Oct. 19.

MBA DEI Leadership Awards: Nomination Deadline Aug. 13

Inspire change; share success. The Mortgage Bankers Association recognizes residential and commercial/multifamily members who show leadership in the areas of Diversity, Equity and Inclusion (DEI) internally through market outreach efforts with its annual DEI Leadership Awards.

MBA Advocacy Update Aug. 9 2021

Last week the Senate Banking Committee held a hearing on several housing nominees, including Julia Gordon to be HUD’s Assistant Secretary of Housing and FHA Commissioner. In other FHA news, the agency released formal waivers of provisions in two recent Mortgagee Letters that would have required servicers to halt forbearance exit reviews and re-review borrowers that already have viable home retention plans in process.

People in the News August 10, 2021

SimpleNexus, Lehi, Utah, announced executive appointments in operations and revenue generation.