The Mortgage Bankers Association’s Risk Management, QA and Fraud Prevention Forum, taking place through MBA Live Sept. 28-29, is the largest annual event for mortgage professionals in the risk, quality control, underwriting and fraud prevention divisions of residential mortgage firms across the country.

Category: News and Trends

MBA Advocacy Update Monday Aug. 30 2021

On Tuesday, the House voted to adopt a $3.5 trillion budget resolution framework for Fiscal Year 2022. Also on Tuesday, MBA submitted a joint coalition letter to HUD on its disparate impact rule.

Quote

“The share of loans in forbearance changed little once again this week, as both new requests and exits remained at a slow pace. We expect a sharp increase in forbearance exits over the next month as many borrowers reach the 18-month mark and see their forbearance plans end. For those borrowers who have exited in August, the majority either enter deferral plans or obtain modifications.”

–Mike Fratantoni, MBA Senior Vice President and Chief Economist.

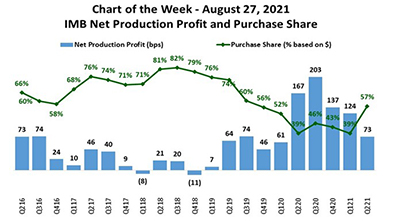

MBA Chart of the Week Aug. 30 2021: IMB Net Production Profit & Purchase Share

In this week’s MBA Chart of the Week, we look at net production profit in basis points, relative to the purchase share of total first mortgage originations by dollar volume over a five-year time span – second quarter 2016 through second quarter 2021.

Call for Speakers: MBA Servicing Solutions Conference & Expo 2022—Deadline Sept. 13

Speaking proposals are now being accepted for the Mortgage Bankers Association’s Servicing Solutions Conference & Expo 2022, taking place February 22-25 in Orlando, Fla.

Greer Allgood of Wipro Opus Risk Solutions: Managing Mortgage Underwriters Remotely

For years, mortgage underwriters have been accustomed to working from home a few days a week; consequently, during the pandemic, it was not much of a challenge to transition to a 100% remote working scenario. What has been a challenge is managing these highly-skilled employees and maintaining their morale at the same time. The great news is that it can be done.

Tim Anderson of Evolve Mortgage Services: Wide eMortgage Adoption Remains Elusive

Tim Anderson is EVP and Director of eMortgage Strategy for Evolve Mortgage Services, where he is responsible for overseeing deployment of the company’s end-to-end digital closing platform and developing strategic partner relationships.

MBA CONVERGENCE Webinar Sept. 16–Mayors and Affordable Housing: Perspective from City Hall

MBA CONVERGENCE presents the next in its Webinar Series, Mayors and Affordable Housing: Perspective from City Hall, on Thursday, Sept. 16 from 1:30-2:15 p.m. ET.

MBA Advocacy Update Monday Aug. 30 2021

On Tuesday, the House voted to adopt a $3.5 trillion budget resolution framework for Fiscal Year 2022. Also on Tuesday, MBA submitted a joint coalition letter to HUD on its disparate impact rule.

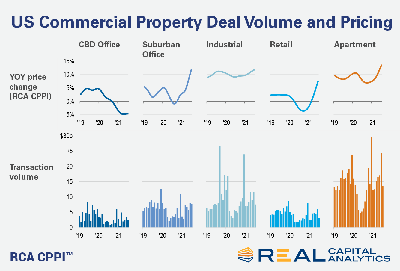

July Sales Activity Expands as Price Growth Accelerates

Real Capital Analytics, New York, reported commercial real estate sales activity climbed in July and the rate of price growth accelerated.