July Sales Activity Expands as Price Growth Accelerates

Chart credit: Real Capital Analytics

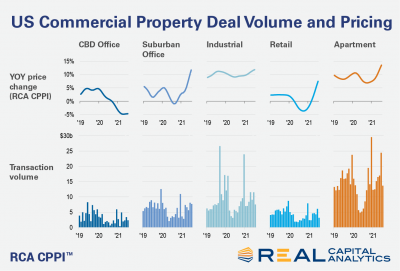

Real Capital Analytics, New York, reported commercial real estate sales activity climbed in July and the rate of price growth accelerated.

Deal volume for the month rose 74 percent compared to a year ago to a higher level than any July since 2005.

The apartment sector was the lead destination for capital in July, making up 35 percent of total commercial real estate investment. The office sector gained ground, comprising 26 percent of sales volume. Suburban office deal activity powered the office sector; sales of central business district properties remained muted due to uncertainty about urban office space use, RCA reported.

The apartment market also led price gains during July. Prices of apartment buildings are up 13.5 percent from a year ago, the largest increase since the housing boom of 2005-2006. RCA’s All-Property Index accelerated to an 11.8 percent year-over-year pace.

Pricing in the office sector has followed the disparate trends in deal activity, RCA said. The suburban office price index jumped 11.7 percent in July from a year ago, while the central business district office index fell 4.6 percent.

Green Street, Newport Beach, Calif., reported its price index of properties owned by real estate investment trusts increased 2.4 percent in July. Its index has gained 14 percent over the past twelve months to a point slightly above pre-COVID levels.

“It’s not surprising to see property prices increase and the velocity of some of the gains, while entirely warranted, is nonetheless impressive,” said Peter Rothemund, Co-Head of Strategic Research at Green Street. “With interest rates as low as they are, private equity shops flush with capital, and many REITs in the bidding tent as well, further price gains are expected.”