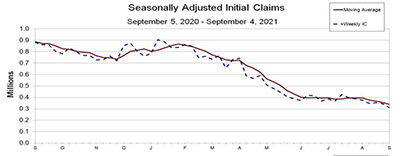

Initial claims for unemployment insurance continued to drop to near pre-pandemic lows, the Labor Department reported Thursday.

Category: News and Trends

Fannie Mae: Consumers More Optimistic About Homebuying Conditions for First Time in 6 Months

The Fannie Mae Home Purchase Sentiment Index was largely unchanged in August, decreasing 0.1 points to 75.7, as survey respondents tempered both their recent pessimism about homebuying conditions and their upward expectations of home price growth.

Ida Losses at $16 – $24 Billion in Insured, Uninsured Flood Losses in Northeast

CoreLogic, Irvine, Calif., released additional loss estimates for Hurricane Ida, following its initial release estimating between $27 billion and $40 billion in insured and uninsured losses from wind, storm surge and inland flooding in Louisiana and Mississippi.

Report Finds Most Consumer Managing Credit Well

Experian, Costa Mesa, Calif., said despite a challenging year and a half, consumers are managing credit well with average credit scores climbing seven points since 2020 to 695 – the highest point in more than 13 years.

HUD: Without New Housing Supply, Cost Burdens to Increase

HUD this week released its latest research on innovative strategies being pursued by state and local governments to remove regulatory barriers to affordable housing and increase housing supply, while cautioning that without “significant” news housing, cost burdens are likely to increase.

Dealmaker: Meridian Capital Group Arranges $55M for New York Mixed-Use Property

Meridian Capital Group, New York, arranged $55 million to refinance The Urban, a Class A mixed-use property in Flushing, Queens, N.Y.

Industry Briefs Sept. 10, 2021: Accurate Group Gets Novacap Investment

Accurate Group, Cleveland, Ohio, a provider of technology-driven real estate appraisal, title data, analytics, and e-closing platforms, entered into a partnership with Novacap, Montreal, a Canadian private equity firm.

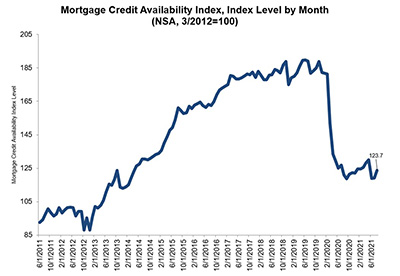

August Mortgage Credit Availability Up Nearly 4%

Mortgage credit availability increased by 3.9 percent in August, the Mortgage Bankers Association reported Thursday morning in its Mortgage Credit Availability Index.

MBA, Trade Groups, MAA Urge Congress to Support Section 1031 Like-Kind Exchanges, Industry Tax Priorities

Ahead of committee action in Congress this week on major infrastructure and economic legislation, the Mortgage Bankers Association and more than three dozen industry trade groups, as well as MBA’s grassroots advocacy arm, the Mortgage Action Alliance, urged senators and representatives to support and defend the real estate finance industry’s tax priorities.

Quote

“The continued strength of demand for housing and favorable home-selling conditions may be offsetting broader concerns about the Delta variant and inflation that have negatively impacted other consumer confidence indices.”

–Mark Palim, Fannie Mae Vice President and Deputy Chief Economist.