Report Finds Most Consumer Managing Credit Well

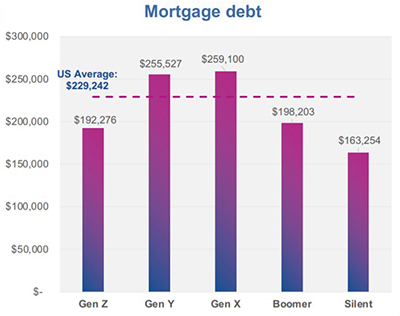

(Chart courtesy Experian State of Credit report.)

Experian, Costa Mesa, Calif., said despite a challenging year and a half, consumers are managing credit well with average credit scores climbing seven points since 2020 to 695 – the highest point in more than 13 years.

The company’s 12th annual State of Credit report noted many consumers were managing credit well before the pandemic’s arrival and the accommodations afforded by the Coronavirus Aid, Relief and Economic Security (CARES) Act may have helped consumers protect their financial health. At the same time, stay-at-home orders and record savings levels may have contributed to lower unsecured and total debt levels, lower credit utilization rates and fewer missed payments.

This year’s report also launched Operation HOPE’s Financial Wellness Index, which found consumers in Minnesota have the highest credit scores with an average of 726, followed by Vermont (719), New Hampshire (718), Washington (717) and Massachusetts (716). States with the lowest credit scores were found in the south, including Mississippi (666), Louisiana (669), Alabama (672), Oklahoma (672) and Texas (673).

“While these findings are positive, we recognize they do not tell the full story and many consumers face financial obstacles due to a limited credit history,” said Alex Lintner, President of Experian Consumer Information Services.

The report found consumers have on average three credit cards with an average balance of $5,525, down from $5,897 in 2020 and $6,494 in 2019. Additionally, the report said average mortgage debt was $229,242; average non-mortgage debt was $25,112; and average auto loan or lease debt was $20,505.

The report said 2.3 percent of consumers had delinquencies between 30-59 days; 1 percent had delinquencies of 60-89 days; and 2.5 percent had delinquencies of 90-180 days. All of these numbers were down substantially from a year ago and two years ago.