On Tuesday, House lawmakers passed a continuing resolution along party lines, sending the measure to the Senate for a vote ahead of a Sept. 30 government funding deadline. Meanwhile, MBA led a coalition of associations urging Congress to raise the federal debt limit to avoid roiling financial markets. And MBA’s Research Institute for Housing America released a report that examines climate change’s growing impact on housing and housing finance.

Category: News and Trends

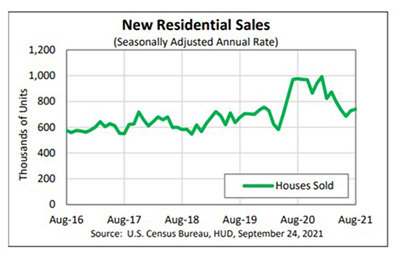

August New Home Sales Pick Up the Pace

New home sales rose in August for the second straight month and at the fastest pace since April, HUD and the Census Bureau reported Friday.

Dealmaker: Avison Young Closes $32M in Industrial, Multifamily Sales

Avison Young, Toronto, negotiated $32.2 million in industrial and multifamily property sales in Florida.

MBA Opens Doors Foundation Kicks Off 2022 Fundraising Season with $3.2 Million in Donations

The MBA Opens Doors Foundation announced it received $3.2 million in corporate and individual donations during its first two days of the FY 2022 fundraising campaign, September 8-9.

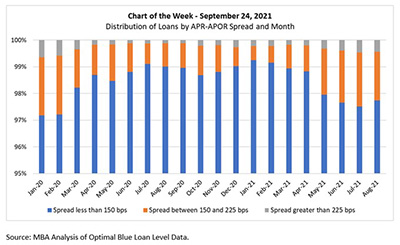

MBA Chart of the Week, Sept. 24, 2021: Distribution of Loans by APR-APOR Spread & Month

In this week’s MBA Chart of the Week, we analyze Optimal Blue single-family, 30-year fixed mortgage rate origination loan data from January 2020 through August 2021. We further group loans in the chart by the spread between their reported note rate and the (monthly average of the) Freddie Mac Primary Mortgage Market Survey rates to approximate the APR-APOR spread.

The Week Ahead Sept. 27, 2021: Five Things to Watch

Good Monday morning! Welcome to the first full week of fall and another busy week for the real estate finance industry. Here are five things to watch for this week:

MBA Annual21: Concert MBA Presents OneRepublic to Benefit MBA Opens Doors Foundation

OneRepublic will take the stage for Concert MBA at the Mortgage Bankers Association’s Annual Convention & Expo to benefit the MBA Opens Doors Foundation.

Brian Vieaux of AXIS Lending Academy: Diversity is Key to Success in Real Estate Finance

Brian Vieaux is a director of AXIS Lending Academy. He is also the president and COO of FinLocker, a provider of next-generation, digital, consumer-permissioned personal financial assistance tools. He has three decades of home lending experience and has held leadership roles at Citigroup, Flagstar and IndyMac Bank.

Copy of Multifamily Market Musings: a Conversation with Fannie Mae’s Kim Betancourt

Kim Betancourt is Fannie Mae’s Senior Director of Economics and Multifamily Research. She manages a team of real estate economists that focus exclusively on the multifamily sector.

Quote

“It is what we do every day, and what inspires our most important fundraising event of the year. I am incredibly proud of the energy, passion and generosity of the real estate finance community and the Mortgage Bankers Association. And I am incredibly grateful that with the support of MBA and its members, we will continue to help families stay in their homes while they care for their sick or injured child.”

–Debra W. Still, CMB, President and CEO of Pulte Financial Services and Chairman of the Opens Doors Foundation Board of Directors.