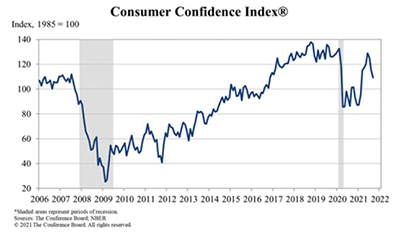

Consumer confidence took another hit in September, The Conference Board reported Tuesday, as the lingering Delta variant and concerns over the economy interrupted momentum sent the index to a seven-month low.

Category: News and Trends

CoreLogic Report Finds Idaho, Wyoming at Disproportionate Economic Risk for Wildfire

You’d think that when analyzing wildfire risk, California would be at the top. But a CoreLogic analysis of additional factors, such as reconstruction resources and economic recovery potential, found that Idaho and Wyoming are the states at most risk.

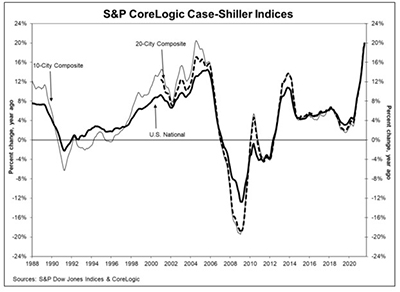

Home Price Index Reports Record-High 19.7% Annual Gain

Annual home price growth of 20 percent—once considered as unrealistic as, say, the Cleveland Browns winning a Super Bowl—is suddenly, like the Browns, a very distinct possibility.

MBA: 2Q Commercial/Multifamily Mortgage Debt Outstanding Up 1.5%

Commercial/multifamily mortgage debt outstanding increased by $60.7 billion (1.5 percent) in the second quarter, according to the Mortgage Bankers Association’s latest Commercial/Multifamily Mortgage Debt Outstanding report.

Quote

“COVID-19 put risk management, quality assurance and fraud prevention at the forefront of real estate finance. From the moment the pandemic hit, you were called into action to an unprecedented extent. Not only did you quickly adopt new standards and practices, but you also did so at a time of record-breaking volume.”

–MBA President & CEO Robert Broeksmit, CMB, opening the MBA Risk Management, QA and Fraud Prevention Summit on Tuesday.

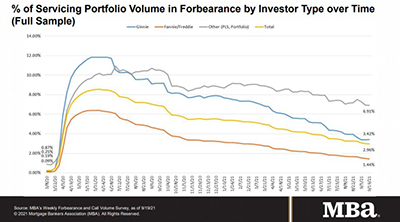

MBA: Loans in Forbearance Fall Under 3%

Loans in forbearance fell to under 3 percent for the first time since March 2020, the Mortgage Bankers Association reported Monday.

People in the News Sept. 29, 2021

CBRE, Dallas, appointed Rachel Vinson as Global Chief Operating Officer for Capital Markets. She lead the operations of CBRE’s global Capital Markets business, consisting of Property Sales, Debt & Structured Finance and Capital Advisors—the firm’s investment banking division.

Louis Casari of HCL Technologies: Leveraging Hyperautomation Lending Solutions to Accelerate Business Growth

By combining multiple advanced technologies such as machine learning and RPA, businesses are innovating their workflows. Lending solutions is a prime area where hyperautomation can deliver significant benefits and accelerate the speed of growth.

MBA Opens Doors Foundation Kicks Off 2022 Fundraising Season with $3.2 Million in Donations

The MBA Opens Doors Foundation announced it received $3.2 million in corporate and individual donations during its first two days of the FY 2022 fundraising campaign, September 8-9.

Multifamily Market Musings: a Conversation with Fannie Mae’s Kim Betancourt

Kim Betancourt is Fannie Mae’s Senior Director of Economics and Multifamily Research. She manages a team of real estate economists that focus exclusively on the multifamily sector.