Leaders need to include software audits in their strategic planning process. A good software audit sets the stage for effective budgeting and decision making this fall. Leaders should analyze the company’s current Application Programming Interface integrations to existing mortgage software.

Category: News and Trends

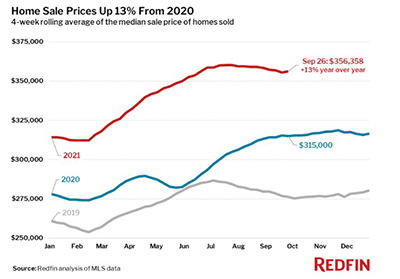

Asking Prices Up 12% to Record High; Other Measures Signal Market Cooling

Asking prices of homes listed for sale increased to a record-high 12%, said Redfin, Seattle, even as other housing market measures continued to show signs of cooling.

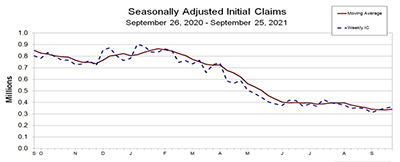

Initial Claims: Two Steps Forward, One Step Back

Initial claims for unemployment insurance increased by 11,000 last week, continuing a recent pattern of erratic performance, the Labor Department reported Thursday.

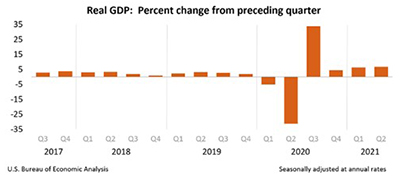

Final 2Q GDP Estimate Ticks Up to 6.7%

The U.S. economy rumbled along at an even faster pace than previously thought, the Bureau of Economic Analysis reported Thursday.

mPowering You: MBA’s Summit for Women in Real Estate Finance Oct. 16

mPowering You, MBA’s Summit for Women in Real Estate Finance, takes place Saturday, Oct. 16 at the San Diego Convention Center just ahead of the MBA Annual Convention & Expo (Oct. 17-20).

RMQA21 Fraud Update: ‘Be Alert For Red Flags’

WASHINGTON, D.C.–The mortgage industry needs to be prepared for increased fraud activity as the pandemic and the recession fade, law enforcement, legal and mortgage servicing experts said at the Mortgage Bankers Association’s Risk Management, QA and Fraud Prevention Forum 2021.

RMQA21: Pandemic Saw Changes in Consumer Behavior—Most of it Good

WASHINGTON, D.C.—The economy continued to improve in 2021, fueled by record consumer savings and strong gains in employment, despite the coronavirus pandemic that could have otherwise ground it to a halt, said Emre Sahingur, Senior Vice President of Predictive Analytics with VantageScore Solutions LLC, Stamford, Conn.

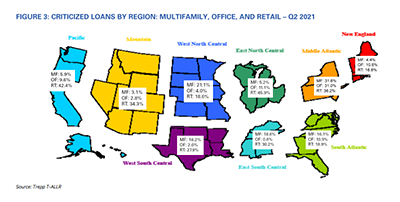

Trepp: Bank Commercial Real Estate Loan Performance ‘Not Bad, But Maybe Not That Great’

Trepp, New York, said delinquency rates for commercial real estate loans held by banks are declining after increasing modestly last year.

Dealmaker: Gantry Secures $103M For The Arrive Apartments & The Sound Hotel Tower

Gantry, San Francisco, secured $102.7 million in financing to retire and replace the construction loan for The Arrive Apartments & The Sound Hotel in Seattle.

SEC Issues Sample Letter to Firms on Climate Change Disclosures

The Securities and Exchange Commission recently gave companies a preview of how it will look at their climate-related disclosures. Specifically, the SEC’s Division of Corporate Finance released a sample letter detailing the sorts of hard questions and requests the SEC will consider when they conduct a review of a company’s disclosures related to climate change.