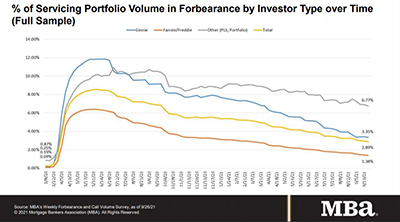

Black Knight, Jacksonville, Fla., said even though just 7% of homeowners in forbearance have less than 10% equity after including 18 months of deferred payments, the potential for foreclosure activity persists.

Category: News and Trends

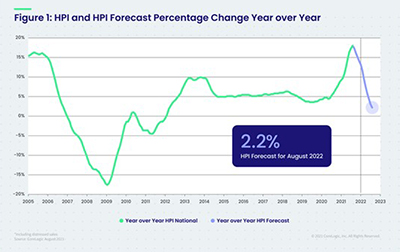

Record-High Repeat: August Home Price Growth Reaches Another High

It’s been quite a year for record-high home prices, and the latest report from CoreLogic, Irvine, Calif., keeps the hot streak going.

RMQA21: Risk Managers Weigh In

WASHINGTON, D.C.–Risk managers worked hard to maintain operations, employee morale and productivity when the pandemic hit, top risk management executives said during the recent Mortgage Bankers Association Risk Management, QA and Fraud Prevention Forum 2021.

Quote

“Commercial and multifamily mortgage performance has improved considerably since the worst of the downturn. The stress that entered–and remains–in the market is largely concentrated in lodging and retail properties, with fewer new loans becoming delinquent and shrinking balances of overall delinquency as lenders and servicers work out the longer-term troubled loans.”

–Jamie Woodwell, MBA Vice President of Commercial Real Estate Research.

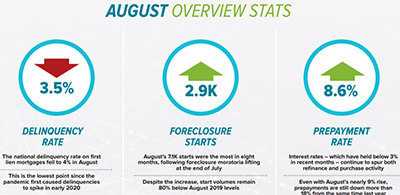

Share of Mortgage Loans in Forbearance Decreases to 2.89%

Loans in forbearance continued their downward trend, the Mortgage Bankers Association reported Monday, and the number of homeowners in forbearance plans fell below 1.5 million.

Student Housing Trends: A Q&A with JLL

MBA NewsLink interviewed JLL Capital Markets Senior Director Teddy Leatherman and JLL Valuation Advisory Senior Vice President Kai Pan about the current state of the student housing market and what might be in store for the sector.

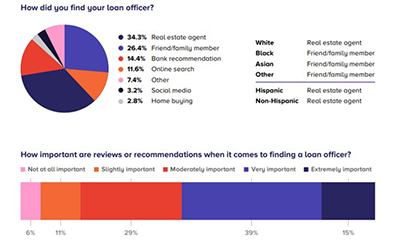

MBA Sponsors 2021 NextGen Homebuyer Report on Consumer Behaviors, Trends

In collaboration with the Mortgage Bankers Association and National MI, Cultural Outreach released the 2021 NextGen Homebuyer Report, which sheds light on the consumer behavior of the largest growing demographic of homebuyers, including insight into the financial behavior and perspectives of a young generation in the midst of a pandemic.

Erika Martin of Enact: How the Customer Experience Has Changed Throughout the Pandemic

Customer interactions in every industry saw significant transitions to digital interactions, but this was an especially large adjustment within the mortgage industry; an industry that still relied heavily on in-person interactions and paper documentation. Let’s discuss just how much the industry has changed in the past year and a half.

SEC Issues Sample Letter to Firms on Climate Change Disclosures

The Securities and Exchange Commission recently gave companies a preview of how it will look at their climate-related disclosures. Specifically, the SEC’s Division of Corporate Finance released a sample letter detailing the sorts of hard questions and requests the SEC will consider when they conduct a review of a company’s disclosures related to climate change.

Jeff Williams of FICS: Support Strategic Planning with Audit of Mortgage Software, API Capabilities

Leaders need to include software audits in their strategic planning process. A good software audit sets the stage for effective budgeting and decision making this fall. Leaders should analyze the company’s current Application Programming Interface integrations to existing mortgage software.