The truth is, there is magic in thinking big, especially for the mortgage industry and especially now. In fact, viewing the industry with a new perspective can only benefit lenders in this changing market.

Category: News and Trends

mPowering You: MBA’s Summit for Women in Real Estate Finance Oct. 16

mPowering You, MBA’s Summit for Women in Real Estate Finance, takes place Saturday, Oct. 16 at the San Diego Convention Center just ahead of the MBA Annual Convention & Expo (Oct. 17-20).

Hotel Sector ‘In a Far Different Place’

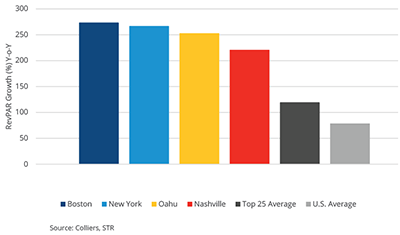

No property type’s fundamentals have rebounded as swiftly as the hotel sector’s, reported Colliers, Toronto.

FHFA Increases Fannie Mae, Freddie Mac Multifamily Loan Purchase Caps

The Federal Housing Finance Agency, Washington, D.C., increased the 2022 multifamily loan purchase caps for Fannie Mae and Freddie Mac to $78 billion each.

Dave Parker of LoanLogics on ‘Confidence Scoring’ and Human Workflow

Dave Parker is Chief Product Officer for LoanLogics, a Jacksonville, Fla.-based provider of loan quality technology for mortgage manufacturing and loan acquisition.

Jim Freeman of Fiserv: Mortgage Magic in Thinking Big

The truth is, there is magic in thinking big, especially for the mortgage industry and especially now. In fact, viewing the industry with a new perspective can only benefit lenders in this changing market.

ATTOM: Foreclosure Activity Sees Uptick as Moratoria Lift

ATTOM, Irvine, Calif., said third-quarter foreclosure filings rose by 34 percent from the second quarter and by 68 percent from a year ago.

Dealmaker: Staley Point, Bain Capital Real Estate Acquire Industrial Property for $32M

Staley Point Capital, Los Angeles, and Bain Capital Real Estate, Boston, acquired 2424 8th Ave S. in Seattle for $31.6 million, or $351 per square foot.

MBA Opens Doors Foundation Marks 10 Years of Resilience and Purpose

The traditional 10-year anniversary gift is tin or aluminum, which symbolize the strength and resilience of a union. But the more modern-leaning gift for a 10th anniversary has become a diamond, to reflect durability. The MBA Opens Doors Foundation’s first decade certainly fits either interpretation.

Nicholas Whiteside Closes the Deal

Nicholas Whiteside, a recent college graduate, Center for Financial Advancement Scholar and former Mortgage Bankers Association summer intern, is a full-circle homeownership success story.