SAN DIEGO–The Mortgage Bankers Association announced recipients of the MBA Opens Doors Foundation annual awards, which recognize those who have made lasting contributions to advance the Foundation’s mission of providing mortgage and rental assistance to families with critically ill or injured children.

Category: News and Trends

mPowering You: MBA Leaders Take the Stage

SAN DIEGO–mPowering You: MBA’s Summit for Women in Real Estate Finance, put together a unique and powerful panel—the only four women in MBA’s 108-year history to serve as Chairman of the Mortgage Bankers Association.

mPowering You: Four New Rules of Success in Today’s New Work Environment

SAN DIEGO—On the fifth anniversary of mPower’s first event here, Mortgage Bankers Association Chief Operating Officer and mPower founder Marcia M. Davies reflected on a tumultuous—and rewarding—period for women in the real estate finance industry.

Industry Briefs Oct. 20, 2021: SimpleNexus Acquires LBA Ware

SimpleNexus, Lehi, Utah, announced its acquisition of software firm LBA Ware, Macon, Ga. The transaction, SimpleNexus’ first, brings together 325 employees in 29 states to serve 425 distinct lender customers and dozens of mortgage technology integration partners.

mPowering You: Looking Ahead—Knowing Your Value and Asking for What You Want

SAN DIEGO—After 18 months as the country and businesses return to normal, what is the new normal in the workplace?

MBA Opens Doors Foundation Announces 2021 Award Winners

SAN DIEGO–The Mortgage Bankers Association announced recipients of the MBA Opens Doors Foundation annual awards, which recognize those who have made lasting contributions to advance the Foundation’s mission of providing mortgage and rental assistance to families with critically ill or injured children.

Today at MBA Annual21

SAN DIEGO—MBA Annual21, the Mortgage Bankers Association’s Annual Convention & Expo, concludes this morning.

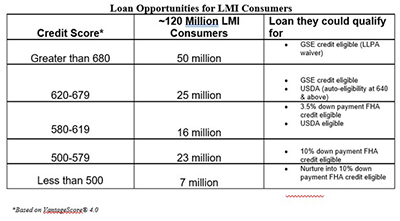

TransUnion: LMI Consumers Present $300 Billion Growth Opportunity for Mortgage Industry

Low-to-moderate income consumers have traditionally been overlooked in the mortgage market and trail non-LMI consumers in terms of homeownership. A new study from TransUnion, Chicago, suggests closing this gap could yield mortgage lenders as much as ~$300 billion in refinance and purchase originations.

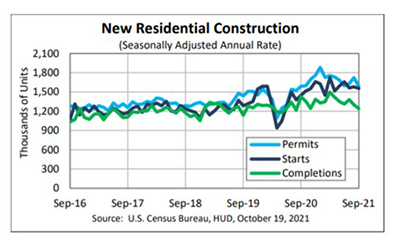

September Housing Starts Slip; Pipeline Remains Strong

Housing starts fell slightly in September, the Census Bureau reported Wednesday, a blip in what has otherwise been a much improved year that, given supply chain issues, could have been even stronger.

Brent Chandler of FormFree: the Business Case for Jumping on the Rent Payment History Bandwagon

The case for considering a mortgage loan applicant’s rent history is compelling. Limited credit history disqualifies many renters ― even those with great rent payment history — from homeownership, and multiple studies confirm that factoring in rent payment history typically increases credit scores.