September Housing Starts Slip; Pipeline Remains Strong

Housing starts fell slightly in September, the Census Bureau reported Wednesday, a blip in what has otherwise been a much improved year that, given supply chain issues, could have been even stronger.

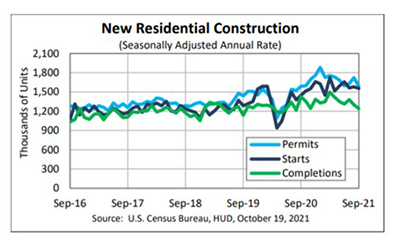

The report said privately owned housing starts in September fell to a seasonally adjusted annual rate of 1,555,000, 1.6 percent below the revised August estimate of 1,580,000, but 7.4 percent higher than a year ago (1,448,000).

Single‐family housing starts in September were unchanged at 1,080,000 from August, after declining for the past two months. The September rate for units in buildings with five units or more fell to 467,000, down by 5.1 percent from August but up by 38 percent from a year ago.

Regionally, results were mixed. Starts in the largest region, the South, fell by 6.3 percent in September to 835,000 units, seasonally annually adjusted, from 891,000 units in August, but improved by 9.4 percent from a year ago. In the Northeast, starts dropped off by 27.3 percent to 120,000 units in September from 165,000 in August and fell by nearly 5 percent from a year ago.

In the West, however, starts jumped by 19.3 percent in September to 383,000 units, seasonally annually adjusted, from 321,000 units in August and improved by nearly 10 percent from a year ago. In the Midwest, starts rose by nearly 7 percent to 217,000 units in September from 203,000 units in August and improved by 3.3 percent from a year ago.

“Despite the decline, new home construction is running at a solid pace,” said Mark Vitner, Senior Economist with Wells Fargo Economics, Charlotte, N.C. “Hurricane Ida, which ripped through wide swathes of the South and Northeast in early September, likely held back new construction in those areas.”

Vitner said building material and skilled labor shortages continue to hamper new residential development. “Lumber supplies have improved significantly this summer; however, a growing list of key material inputs, such as copper and steel, remain in short supply,” he said. “We expect these supply constraints to ease somewhat this fall and winter, as construction enters a seasonally slow period in the Northeast and Midwest, freeing up resources for the South and West.”

Building Permits

The report said privately owned housing units authorized by building permits in September fell to a seasonally adjusted annual rate of 1,589,000, 7.7 percent below the revised August rate of 1,721,000, but unchanged from a year ago. Single‐family authorizations in September fell to 1,041,000; 0.9 percent below the revised August figure of 1,050,000. Authorizations of units in buildings with five units or more fell to 498,000 in September, down by 21 percent from August but up by 18 percent from a year ago.

Housing Completions

Privately owned housing completions in September fell to a seasonally adjusted annual rate of 1,240,000, 4.6 percent below the revised August estimate of 1,300,000 and 13 percent lower than a year ago. Single‐family housing completions in September were unchanged at 953,000; the September rate for units in buildings with five units or more fell to 280,000, down by 18.1 percent from August and down by nearly 42 percent from a year ago.