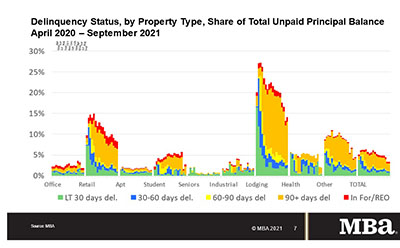

Delinquency rates for mortgages backed by commercial and multifamily properties declined in September, the Mortgage Bankers Association’s latest CREF Loan Performance Survey reported.

Category: News and Trends

Dealmaker: Mapletree Acquires 141 Logistics Assets for $3 Billion

Mapletree Investments Ltd., Singapore, acquired two U.S. logistics portfolios totaling 141 assets for $3 billion.

Industry Briefs Oct. 6, 2021: WFG Whitepaper Examines Title Agent-Underwriter Relationship

WFG National Title Insurance Co., Portland Ore., published a new whitepaper that explores the title agent-underwriter relationship in great detail. The paper, “Creating a True Partnership Between Title Agencies and Underwriters,” is available as a free download on the WFG Blocks website.

Joseph D’Urso of TitleEase on Franchising Title Agencies

MBA NewsLink spoke with Joseph D’Urso, CEO of TitleEase, on the advantages of the franchise model and its potential benefits to lenders.

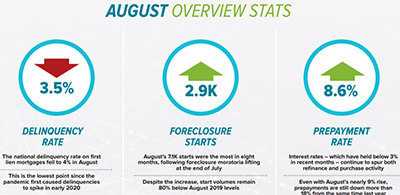

Black Knight: Strong Equity Could Affect Foreclosure Starts

Black Knight, Jacksonville, Fla., said even though just 7% of homeowners in forbearance have less than 10% equity after including 18 months of deferred payments, the potential for foreclosure activity persists.

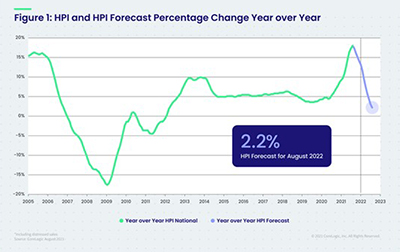

Record-High Repeat: August Home Price Growth Reaches Another High

It’s been quite a year for record-high home prices, and the latest report from CoreLogic, Irvine, Calif., keeps the hot streak going.

RMQA21: Risk Managers Weigh In

WASHINGTON, D.C.–Risk managers worked hard to maintain operations, employee morale and productivity when the pandemic hit, top risk management executives said during the recent Mortgage Bankers Association Risk Management, QA and Fraud Prevention Forum 2021.

Quote

“Commercial and multifamily mortgage performance has improved considerably since the worst of the downturn. The stress that entered–and remains–in the market is largely concentrated in lodging and retail properties, with fewer new loans becoming delinquent and shrinking balances of overall delinquency as lenders and servicers work out the longer-term troubled loans.”

–Jamie Woodwell, MBA Vice President of Commercial Real Estate Research.

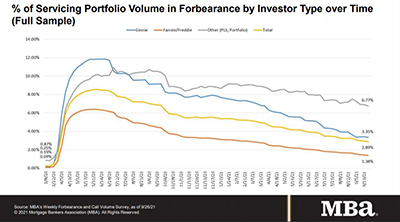

Share of Mortgage Loans in Forbearance Decreases to 2.89%

Loans in forbearance continued their downward trend, the Mortgage Bankers Association reported Monday, and the number of homeowners in forbearance plans fell below 1.5 million.

Student Housing Trends: A Q&A with JLL

MBA NewsLink interviewed JLL Capital Markets Senior Director Teddy Leatherman and JLL Valuation Advisory Senior Vice President Kai Pan about the current state of the student housing market and what might be in store for the sector.