The Consumer Financial Protection Bureau and the Department of Justice, in cooperation with the Office of the Comptroller of the Currency, alleged Trustmark National Bank of Jackson, Miss., engaged in redlining against Black and Hispanic neighborhoods in Memphis, Tenn.

Category: News and Trends

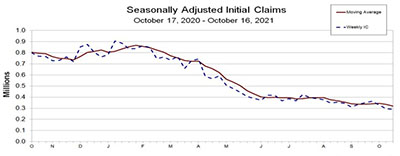

Unemployment Claims Edge Closer to Pre-Pandemic Levels

Initial claims for unemployment insurance fell to a new post-pandemic low last week, the Labor Department said, edging closer to pre-pandemic levels.

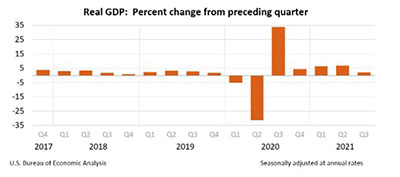

Supply Chain Issues Show Up in 3Q Gross Domestic Product

We’ve been hearing a lot of news lately about the U.S. economy being hamstrung by supply chain issues. On Thursday, the Bureau of Economic Analysis appeared to quantify those issues.

September Pending Home Sales Dip 2.3%

Pending home sales fell back in September after improving in August, the National Association of Realtors reported Thursday. Each of the four major U.S. regions saw contract activity decline month-over-month and year-over-year, with the Northeast seeing the largest yearly drop.

FHFA Proposed Rulemaking Adds Public Disclosure Requirements for GSE Regulatory Capital Framework

The Federal Housing Finance Agency this week issued a notice of proposed rulemaking that would introduce additional public disclosure requirements to the Enterprise Regulatory Capital Framework for Fannie Mae and Freddie Mac.

Dealmaker: Hall Structured Finance Closes $74M for Hotel, Multifamily Assets

Hall Structured Finance, Dallas, closed $74.1 million in bridge and construction financing for assets in Oregon and Colorado.

MBA Announces 2022 Affordable Homeownership Advisory Council

The Mortgage Bankers Association announced members of its 2022 Affordable Homeownership Advisory Council.

Quote

“Consumers are willing and able to spend, but the goods are just not available. That description certainly includes the housing market, as residential investment declined again for the quarter, a witness to builders’ ongoing struggles to obtain key construction inputs.”

–MBA Chief Economist Mike Fratantoni.

Sam Verma of Peoples Processing: Automation–A Critical Element for the Emerging Non-QM Sector

Against the background of plummeting refinance activity, there has been a growing level of competition to service limited loan volume. Coupled with the tighter business conditions, market norms have rapidly changed, and so have the borrower profile. These changes have been encouraging lenders to consider getting into the Non-QM space to ensure smooth business continuity.

Worried about Tapering? Chris Bennett Says ‘Relax’

It’s not often the mortgage industry plays coy when it comes to certain topics, but currently, there are rumblings about the T-word – tapering. There’s a couple of misconceptions about tapering and what that might mean, especially for mortgages and mortgage-backed securities. Let’s clear those up.