Supply Chain Issues Show Up in 3Q Gross Domestic Product

We’ve been hearing a lot of news lately about the U.S. economy being hamstrung by supply chain issues. On Thursday, the Bureau of Economic Analysis appeared to quantify those issues.

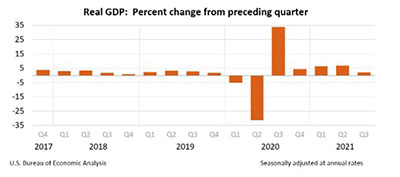

In its first (advance) estimate of third quarter Gross Domestic Product, BEA said real gross domestic product increased at an annual rate of 2 percent, well down from the second quarter, in which real GDP increased 6.7 percent.

The first estimate is based on source data that are incomplete or subject to further revision by the source agency.

BEA said the increase in real GDP in the third quarter reflected increases in private inventory investment, personal consumption expenditures, state and local government spending and nonresidential fixed investment that were partly offset by decreases in residential fixed investment, federal government spending and exports. Imports, which are a subtraction in the calculation of GDP, increased. The increase in third quarter GDP also reflected the continued economic impact of the COVID-19 pandemic.

The report said the deceleration in real GDP in the third quarter was more than accounted for by a slowdown in PCE. From the second quarter to the third quarter, spending for goods turned down (led by motor vehicles and parts) and services decelerated (led by food services and accommodations).

The report said disposable personal income decreased $29.4 billion, or 0.7 percent, in the third quarter, compared with a decrease of $1.39 trillion, or 25.7 percent, in the second quarter. Real disposable personal income decreased 5.6 percent, compared with a decrease of 30.2 percent. Personal saving fell to $1.60 trillion in the third quarter, from $1.90 trillion in the second quarter. The personal saving rate—personal saving as a percentage of disposable personal income—fell to 8.9 percent in the third quarter, from 10.5 percent in the second quarter.

“Following several quarters of a robust economic recovery, the pace of activity slowed in the third quarter as household spending growth on durable goods declined – most notably for motor vehicles – while spending on services remained stronger,” said Mike Fratantoni, Chief Economist with the Mortgage Bankers Association. “This distinction highlights the supply chain issues that continue to bedevil the economy. Consumers are willing and able to spend, but the goods are just not available. That description certainly includes the housing market, as residential investment declined again for the quarter, a witness to builders’ ongoing struggles to obtain key construction inputs.”

“Supply chain constraints, which are causing many prices to rise sharply and making many goods simply unavailable, were evident in the underlying details,” said Jay Bryson, Global Chief Economist with Wells Fargo Economics, Charlotte, N.C. “The only saving grace was that inventories did not decline as much in the third quarter as they did in Q2. Without that positive contribution from inventories, the U.S. economy would have essentially stalled in the third quarter.”

Bryson said growth should rebound, albeit not to the pace seen earlier this year, as supply chains become unglued. “The need to re-stock empty shelves and continued resilience in consumer spending should underpin spending growth,” he said. “But unblocking supply chains will take time. We look for the rate of consumer price inflation, which rose to a 31-year high in the third quarter, to slow next year. But we also do not think that it will recede all the way back to 2%, as some policymakers at the Federal Reserve expect.”