Good morning! Happy week before Thanksgiving Week. Here are a few things to look out for this week:

Category: News and Trends

CREF22 in San Diego Feb. 13-16

The Mortgage Bankers Association’s Commercial Real Estate Finance/Multifamily Housing Convention & Expo takes place Feb. 13-16 at the Manchester Grand Hyatt in San Diego.

Quote

“There are deeply embedded structural, market and policy factors that have contributed to the racial homeownership gap over the past century—and there is no quick, easy solution. CONVERGENCE alone won’t eliminate the homeownership gap here in Columbus- but we must start somewhere.”

–Dr. Stephanie Moulton, Professor with the John Glenn College of Public Affairs at The Ohio State University, Columbus, Ohio and co-lead of the Evaluation Framework Working Group for CONVERGENCE Columbus.

Rick Triola of NotaryCam: Worried About RON Storage? Stream It

Both Fannie Mae and Freddie Mac have updated their selling guides to state that lenders must retain the audio-video recording of the RON transaction for the greater of either (a) the minimum period required by the state in which the notary is licensed or (b) 10 years. This guideline has left a lot of lenders wondering just how to store all that audio-video footage…and spurred a new crop of vendors ready to meet this “need.”

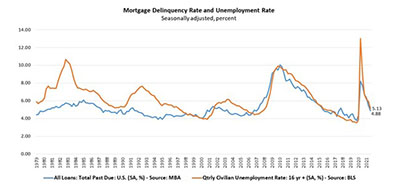

MBA: Mortgage Delinquencies Decline for 5th Straight Quarter

Mortgage delinquencies fell for the fifth straight quarter to well under 5 percent, the Mortgage Bankers Association reported Wednesday.

Industry Briefs Nov. 12, 2021: Ginnie Mae October MBS Issuance Tops $69B

Ginnie Mae, Washington, D.C. reported mortgage-backed securities issuance volume for October rose to $69.36 billion. It said 253,996 homes and apartment units were financed by Ginnie Mae guaranteed MBS.

Regina Braga of Res/Title: Margin Compression Doesn’t Have to Be Inevitable in a Competitive Market

Lenders should consider examining existing or new service providers for critical services (title, appraisal or other elements of the mortgage process that would be difficult to produce in-house, but without which, a purchase mortgage transaction simply cannot take place) much as they would their own, internal cost centers.

Nomi Smith of PMI Rate Pro: How to Build a Stronger Mortgage Business Now

It’s time to make a decision. What will you be doing in 2022? If you’re in the mortgage industry and you think you’ll still be in the business next year, there’s a good chance you’re wrong. The business will shrink next year and many who are working here now won’t be here by the end of the year.

People in the News Nov. 15, 2021

Wipro Opus Risk Solutions LLC, Lincolnshire, Ill., appointed Kebra Rhedrick as Chief Compliance Counsel.

Mark P. Dangelo: Coming to a Store Near YOU, the Low-Code/No-Code Revolution

The time to effectively transform our analysis of all things digital is being reduced from months to days. The revolution and rapid embrace of low-code/no-code solutions by giant Walmart will set off multiple tangential strategies to influence the consumer—all in the hands of newly empowered, front-line domain experts.