The time to effectively transform our analysis of all things digital is being reduced from months to days. The revolution and rapid embrace of low-code/no-code solutions by giant Walmart will set off multiple tangential strategies to influence the consumer—all in the hands of newly empowered, front-line domain experts.

Category: News and Trends

Rick Triola of NotaryCam: Worried About RON Storage? Stream It

Both Fannie Mae and Freddie Mac have updated their selling guides to state that lenders must retain the audio-video recording of the RON transaction for the greater of either (a) the minimum period required by the state in which the notary is licensed or (b) 10 years. This guideline has left a lot of lenders wondering just how to store all that audio-video footage…and spurred a new crop of vendors ready to meet this “need.”

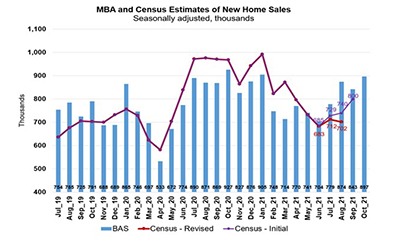

MBA: October New Home Applications Up 6% From September, Down 15.2% from Year Ago

The Mortgage Bankers Association’s Builder Application Survey data for October show mortgage applications for new home purchases increased by 6 percent from September, but decreased by 15.2 percent from a year ago.

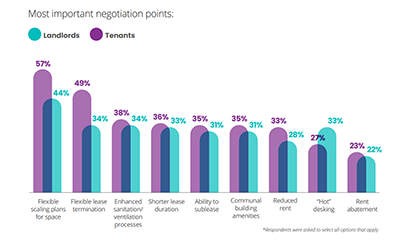

Tenants Committing to Longer Leases

Commercial real estate tenants are ready to commit to longer lease terms, reported software firm Visual Lease, Woodbridge, N.J.

Dealmaker: Greystone Capital Advisors Arranges $77M Multifamily Refinance

Greystone Capital Advisors, New York, arranged a $77.2 million loan for a joint venture between Young Cos. and Phil Craft to refinance to refinance The Rockwell in New Rochelle, N.Y.

J.D. Power: Record Origination Volume Causes Customer Satisfaction to Erode

There are two main takeaways from the J.D. Power 2021 U.S. Primary Mortgage Origination Satisfaction Study: first, there can be too much of a good thing; and second, Rocket Mortgage/Quicken Loans didn’t top the customer satisfaction list for the first time in 11 years.

FHA Actuarial Report: Capital Ratio Grows to 8.03%; HECM Ratio Positive for First Time Since 2015

HUD on Monday released its fiscal year 2021 report to Congress on the financial health of the Federal Housing Administration Mutual Mortgage Insurance Fund, showing a nearly 2 percent increase in the fund’s capital ratio to more than 8 percent, well above its congressionally mandated minimum of 2 percent.

FHA Actuarial Report: Capital Ratio Grows to 8.03%; HECM Ratio Positive for First Time Since 2015

HUD on Monday released its fiscal year 2021 report to Congress on the financial health of the Federal Housing Administration Mutual Mortgage Insurance Fund, showing a nearly 2 percent increase in the fund’s capital ratio to more than 8 percent, well above its congressionally mandated minimum of 2 percent.

Quote

“The continued strengthening of the FHA Mutual Mortgage Insurance Fund is a welcome development that highlights the strong financial stewardship of the Fund by HUD and other stakeholders, including lenders. A healthy FHA program is necessary to ensure the broad availability of sustainable mortgage credit to low- and moderate-income households, minority borrowers, first-time homebuyers and other historically underserved communities.”

–MBA President & CEO Robert Broeksmit, CMB.

COMBOG Corner: Interview with StanCorp’s Amy Frazey

Commercial real estate lending markets are on a tear heading into the last months of 2021. Life insurance companies are one of many capital sources benefiting from improved transaction volumes and economic fundamentals.