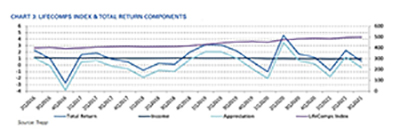

Trepp LLC, New York, said commercial mortgage investments held by life insurance companies saw modest returns in the third quarter

Category: News and Trends

Dealmaker: George Smith Partners Secures $36M

George Smith Partners, Los Angeles, secured $35.6 million for office and retail assets in California and Missouri.

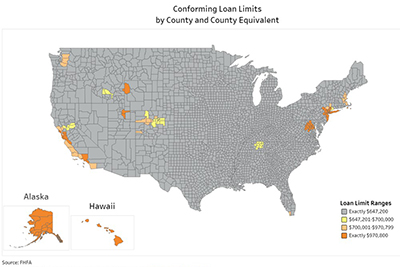

2022 GSE Conforming Loan Limits Rise 18.5% to $647,200

Conforming loan limits for Fannie Mae and Freddie Mac will rise to $647,200 jump in 2022, the Federal Housing Finance Agency said on Tuesday—a jump of nearly $100,000 from 2021’s previous record high.

Multifamily Minute: Perspective from Lument’s Chad Musgrove

Chad Musgrove is Associate Director with Lument, a subsidiary of ORIX Corporation USA. He has a decade of experience in real estate and financial services consulting.

Quote

“FHFA has raised the conforming loan limits, as prescribed under HERA, to reflect the rise in the average U.S. home price. Over the last 18 months, housing prices have significantly increased due to record low inventory levels amidst strong demand. The higher loan limits reflect this dynamic.”

–MBA President & CEO Robert Broeksmit, CMB.

MBA: 3Q IMB Production Profits Increase

Independent mortgage banks and mortgage subsidiaries of chartered banks reported a net gain of $2,594 on each loan they originated in the third quarter, up from $2,023 per loan in the second quarter, according to the Mortgage Bankers Association’s Quarterly Mortgage Bankers Performance Report.

CREF22 in San Diego Feb. 13-16

The Mortgage Bankers Association’s Commercial Real Estate Finance/Multifamily Housing Convention & Expo takes place Feb. 13-16 at the Manchester Grand Hyatt in San Diego.

Quote

“Net production profit rebounded in the third quarter of 2021 after a drop-off in the second quarter, but was down more than half from the record profit one year ago. Production revenue was the difference-maker, increasing more than 20 basis points from the second quarter. However, production revenue was still down almost 80 basis points compared to a year ago.”

–Marina Walsh, CMB, MBA Vice President of Industry Analysis.

Lenders One Webinar Dec. 2: Forecasting Session with MBA

Lenders One and the Mortgage Bankers Association have teamed up to offer a Dec. 2 webinar to help you enhance your strategy for the next year in the middle of an unparalleled time in our industry.

MBA: 3Q IMB Production Profits Increase

Independent mortgage banks and mortgage subsidiaries of chartered banks reported a net gain of $2,594 on each loan they originated in the third quarter, up from $2,023 per loan in the second quarter, according to the Mortgage Bankers Association’s Quarterly Mortgage Bankers Performance Report.