Life Insurance Commercial Mortgages Post Modest Return

Trepp LLC, New York, said commercial mortgage investments held by life insurance companies saw modest returns in the third quarter.

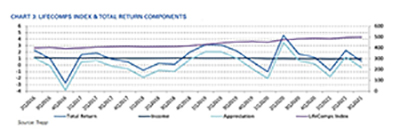

Life company CRE mortgage investments posted a 0.63 percent total return in the quarter. “The modest return is attributed to a decline in reported loan values,” said Jennifer Dimaano, Economic Data Analyst with Trepp.

Returns have varied significantly this year, bouncing back in the second quarter after turning negative in early 2021, Trepp said in its LifeComps report.

Dimaano noted economic growth was hindered during the quarter as short-term inflation became a longer-term concern. “The Fed remained dovish on inflation and maintained a ‘wait-and-see’ attitude in the third quarter,” she said.

Treasury yields declined steadily during the quarter. Yields decreased 22 basis points in the third quarter after hitting a recent high 174 basis points in early 2021. “Interest rates remain low and demand for goods continues to surge despite supply chain chokeholds,” Trepp said. “Adding to supply chain woes, labor market shortages in the third quarter created a demand for workers, especially in the hospitality space…Properties that would normally have hospitality workers saw the highest returns in the LifeComps portfolio in the quarter.”

Trepp said lodging properties saw the highest total returns among property types during the quarter with a 1.37 percent return. “Booster shots are rolling out and travel is gaining momentum, with the number of COVID-19 cases dropping,” the report said.

Retail property returns ranked second at 0.98 percent. “This growth was driven by pent-up demand as consumer spending continued at a robust pace in the third quarter, exceeding expectations,” Trepp said.

Despite growing demand for industrial properties, industrial loans earned just a 0.66 percent return during the quarter, contributing to a 4.09 percent 12-month return. The multifamily sector beat out the industrial sector’s 12-month performance with a 7.81 percent return.

The report said the quarter-over-quarter change in specific reserves increased 11 percent ($13.2 million net) between July and September, resulting in a $130.8 million specific reserve balance while loan underwriting has eased.