SAN DIEGO–Twenty percent ($929 billion) of the $4.7 trillion of outstanding commercial mortgages held by lenders and investors will mature in 2024, a 28% increase from the $729 billion that matured in 2023, according to the Mortgage Bankers Association’s 2023 Commercial Real Estate Survey of Loan Maturity Volumes, released here at the 2024 Commercial/Multifamily Finance Convention and Expo.

Tag: Jamie Woodwell

MBA: Commercial/Multifamily Borrowing Down 25% in the Fourth Quarter–#MBACREF24

SAN DIEGO–Commercial and multifamily mortgage loan originations were 25 percent lower in the fourth quarter of 2023 compared to a year earlier, and increased 13 percent from the third quarter of 2023, according to the Mortgage Bankers Association’s Quarterly Survey of Commercial/Multifamily Mortgage Bankers Originations, released here at MBA’s Commercial/Multifamily Finance Convention and Expo.

MBA’s Commercial/Multifamily Finance Servicing and Technology Conference: General Session Highlight

At the MBA’s Commercial/Multifamily Finance Servicing and Technology Conference, on Monday, May 20, from 10 a.m. to 10:50 a.m., MBA’s AVP of Commercial Research, Reggie Booker, and Head of Commercial Real Estate Research, Jamie Woodwell, will take the stage during a General Session: Market Outlook.

MBA CREF Forecast: Commercial/Multifamily Borrowing and Lending Expected to Increase to $576 Billion in 2024

Total commercial and multifamily mortgage borrowing and lending is expected to rise to $576 billion in 2024, which is a 29% increase from 2023’s estimated total of $444 billion. This is according to an updated baseline forecast released today by the Mortgage Bankers Association (MBA).

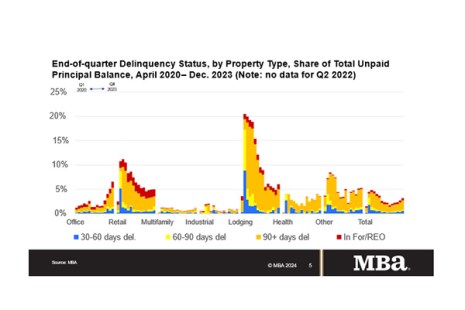

MBA: Delinquency Rates for Commercial Properties Increased in Fourth-Quarter 2023

Delinquency rates for mortgages backed by commercial properties increased during the fourth quarter of 2023, according to the Mortgage Bankers Association’s latest commercial real estate finance Loan Performance Survey.

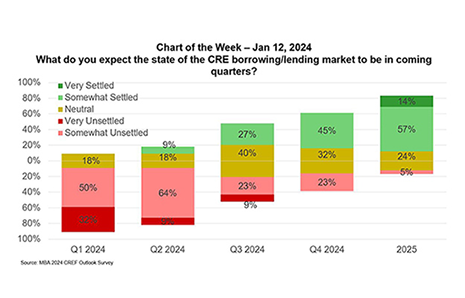

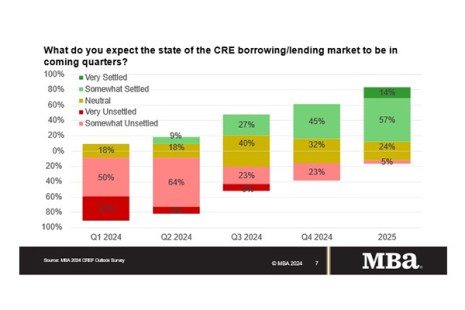

MBA Chart of the Week: Expectations for the CRE Borrowing/Lending Market

Even though many commercial real estate loans are long-lived, with terms of five, seven, 10, or more years, there’s a sense that the industry starts each year fresh.

MBA CREF Outlook Survey: Markets Expected to Become Less Unsettled as 2024 Progresses

Commercial and multifamily mortgage originators continue to experience an unsettled market for borrowing and lending but anticipate those conditions will stabilize over the course of 2024.

MBA: Commercial and Multifamily Mortgage Debt Outstanding Increased by $37 Billion in Third-Quarter 2023

The level of commercial/multifamily mortgage debt outstanding increased by $37.1 billion (0.8%) in the third quarter of 2023, according to the Mortgage Bankers Association’s (MBA) latest Commercial/Multifamily Mortgage Debt Outstanding quarterly report.

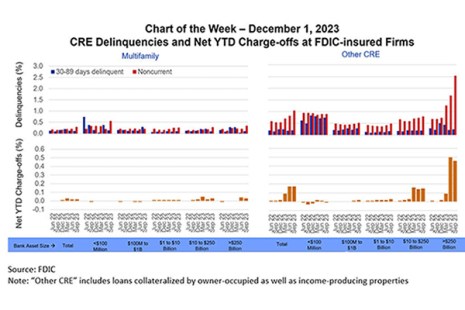

MBA Chart of the Week: CRE Delinquencies and Net YTD Charge-offs at FDIC-Insured Firms

Since March 2023, a recurring set of questions has revolved around a) how conditions in commercial real estate are affecting banks and b) how conditions with banks are affecting CRE.

MBA: Commercial Mortgage Delinquency Rates Increased in Third Quarter

Commercial mortgage delinquencies increased in the third quarter, according to the Mortgage Bankers Association’s latest Commercial Delinquency Report.