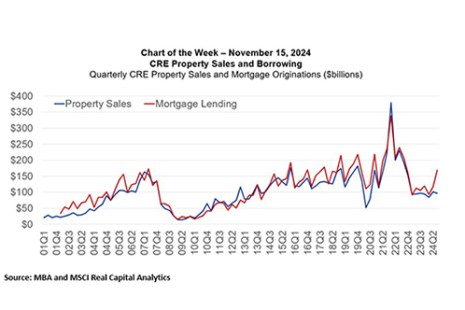

After a slow start to this year, borrowing and lending backed by commercial real estate properties picked up during the third quarter. Originations increased 59% compared to a year ago and increased 44% from the second quarter of 2024.

Tag: Chart of the Week

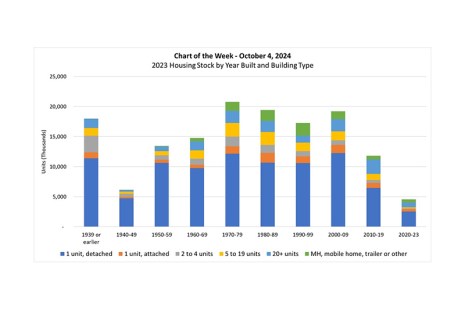

MBA Chart of the Week: 2023 Housing Stock by Year Built and Building Type

At the end of September 2024, the U.S. Department of Housing and Urban Development (HUD) and the U.S. Census Bureau released 2023 American Housing Survey (AHS) data.

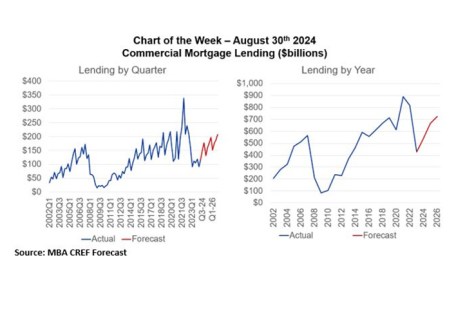

MBA Chart of the Week: Commercial Mortgage Lending

Is the logjam in CRE transaction activity starting to break?

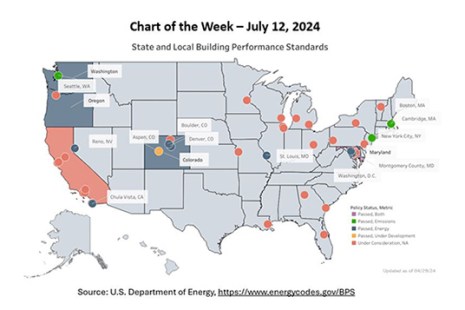

MBA Chart of the Week: State, Local Building Performance Standards

New York City has Local Law 97. Washington D.C. has its Building Energy Performance Standards (BEPS). Seattle has its Building Emissions Performance Standards (also BEPS). Denver has its Building Performance Policy (BPP).

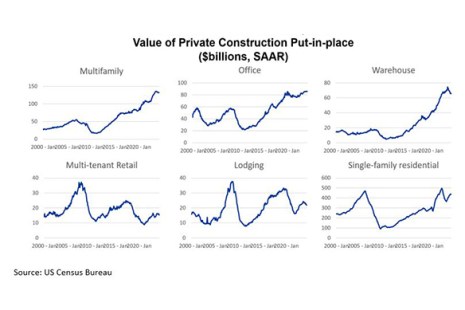

MBA Chart of the Week: Value of Private Construction Put-in-Place

Physicists have protons, neutrons, and electrons. Biologists have DNA and RNA. And economists have supply and demand — the building blocks upon which most of our understanding of markets rest.

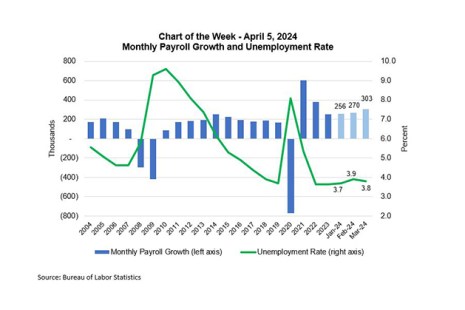

MBA Chart of the Week: Payroll Growth and Unemployment

Our Chart of the Week focuses on Friday’s Employment Situation report released by the Bureau of Labor Statistics.

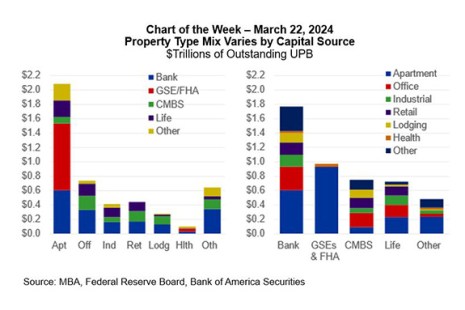

MBA Chart of the Week: CRE Mortgage Debt Across Capital Sources, Property Types

This week’s Chart of the Week shows MBA’s estimates of the distribution of CRE mortgage debt across capital sources and property types and is derived from a variety of public and private sources.

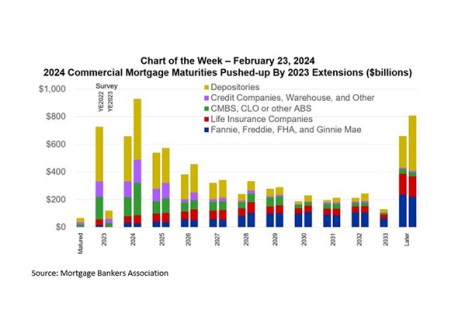

MBA Chart of the Week: 2024 Commercial Mortgage Maturities Pushed Up by 2023 Extensions

Commercial mortgages tend to be relatively long-lived, spreading maturities out over several years.

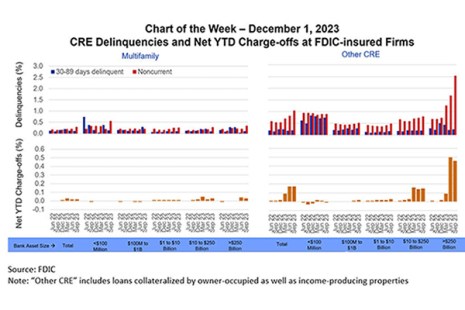

MBA Chart of the Week: CRE Delinquencies and Net YTD Charge-offs at FDIC-Insured Firms

Since March 2023, a recurring set of questions has revolved around a) how conditions in commercial real estate are affecting banks and b) how conditions with banks are affecting CRE.

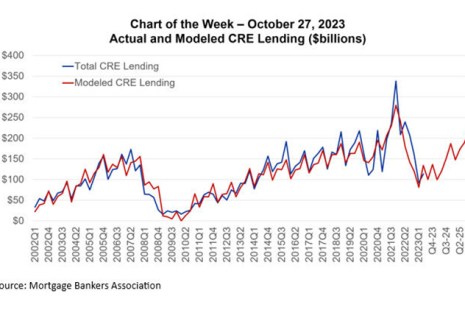

MBA Chart of the Week: Actual and Modeled CRE Lending ($Billions)

MBA’s latest commercial real estate finance (CREF) forecast anticipates 2023 origination volumes ($442 billion) will come in just a bit more than half of what they were in 2022 ($816 billion).