Trepp: CMBS Delinquency Rate Increased Slightly in May

(Image courtesy of Trepp; Breakout image courtesy of Ion Ceban/pexels.com)

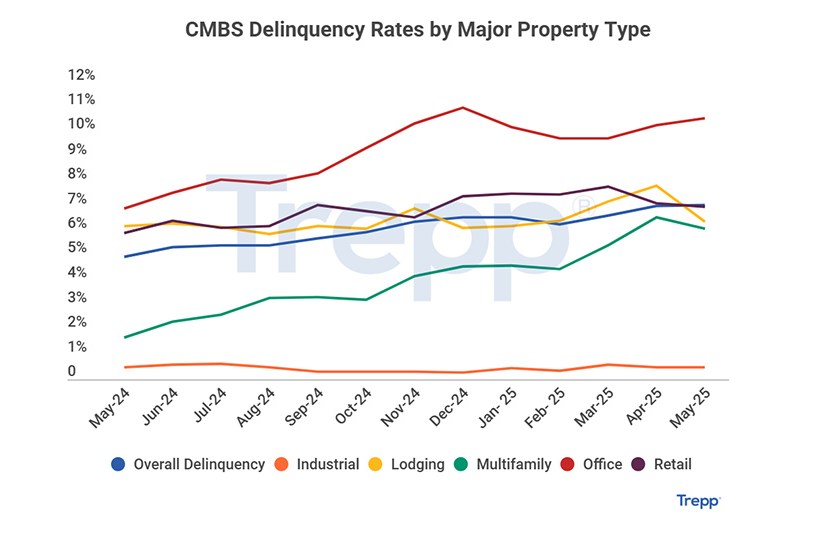

Trepp, New York, reported that its CMBS delinquency rate rose to 7.08% in May, up five basis points.

The overall delinquent balance was $42.6 billion, up from $41.9 billion in April, which marked a four-year high.

Year-over-year the overall U.S. CMBS delinquency rate is up 211 basis points.

By sector, the results were mixed. Lodging saw a 146-basis-point decline, to 6.39%. The multifamily rate also fell, down 46 basis points to 6.11%. However, that’s still 441 basis points higher than a year ago.

Retail fell to 6.64%, down 14 basis points. And industrial fell by two basis points to 0.48%.

However, the office rate rose by 31 basis points to 10.54% in May. The office rate has been up and down over the past few years–it hit an all-time high of 11.01% last December. But, May’s result is still more than 350 basis points higher than May 2024.

Also driving the change to the overall rate–$2 billion in mixed-use loans became newly delinquent in May.

If the report included loans that are past their maturity date but current on interest, the delinquency rate would be 8.64%, up 27 basis points from April.

The percentage of loans in the 30-days delinquent bucket is 0.49%, flat from April.

The percentage of loans that are seriously delinquent–defined as 60-plus days delinquent, in foreclosure, REO or nonperforming balloons–is at 6.59%, up five basis points.

If defeased loans were taken out of the equation, the overall headline delinquency rate would be 7.28%, up one basis point from April.

The CMBS 2.0+ delinquency rate rose four basis points in May, to 6.99%.