Commercial and Multifamily Mortgage Debt Outstanding Increased in First Quarter: MBA

The level of commercial/multifamily mortgage debt outstanding increased by $40.1 billion (0.9%) in the first quarter, according to the Mortgage Bankers Association’s latest Commercial/Multifamily Mortgage Debt Outstanding quarterly report.

CREF Policy Update: Owen Lee of Success Mortgage Partners Inc., Nominated to Be 2025 MBA Vice Chairman

Commercial and multifamily developments and activities from MBA important to your business and our industry.

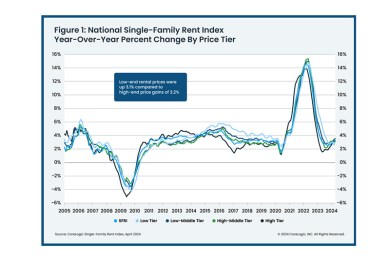

CoreLogic: U.S. Single-Family Rents Grew 3% in April

Single-family rents nationwide grew 3% year-over-year in April, CoreLogic, Irvine, Calif., reported, consistent with growth recorded over the past year.

Fitch Forecasts Office Performance Will Worsen Through 2025

Commercial real estate office loan performance will weaken further as market pressures build, according to Fitch Ratings’ latest U.S. CMBS Office Dashboard.

Yardi Matrix Anticipates Minimal Rent Growth for Second Half of Year

Yardi Matrix, Santa Barbara, Calif., released its U.S. Multifamily Outlook for Summer 2024, finding that while multifamily performance continues to be strong, rent growth is likely to remain slow through the rest of the year.

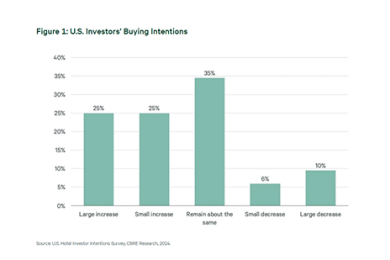

CBRE: Half of U.S. Hotel Investors Plan to Buy More This Year

CBRE, Dallas, reported that investors have generally positive sentiment about the hotel market this year.

TransUnion: Consumer Outlook Mixed in Q2

TransUnion, Chicago, released its Consumer Pulse Study for the second quarter, finding consumer concerns about inflation and interest rates have hit their highest levels in two years. However, more than half of Americans remain optimistic about their household finances over the next year.

Dealmaker: Greystone Closes $22.9M Transaction for Texas Multifamily Property

Greystone, New York, closed a bridge loan debt placement and preferred equity component to refinance a multifamily property in Fort Worth, Texas. The financing totaled $22.9 million.