FHA Increases Threshold for Large Multifamily Loans to Be Eligible for Standard Underwriting

The Federal Housing Administration on Wednesday increased the threshold at which a multifamily loan is considered a large loan from $75 million to $120 million. The Mortgage Bankers Association commended the move.

CREF Policy Update: June 29, 2023

Commercial and multifamily developments and activities from MBA important to your business and our industry.

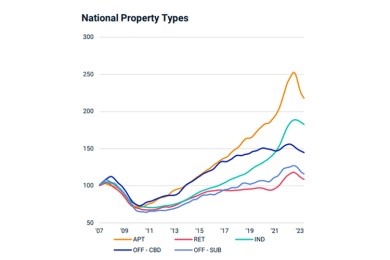

May CPPI Indexes Show Large Drops From 2022

MSCI, New York, reported its RCA CPPI National All-Property index dropped 11.2% year-over-year and 1.2% from April, as commercial property pricing for all major sectors continued to post annual declines in May.

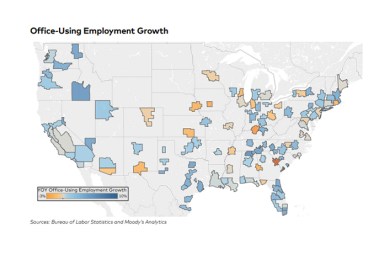

City-by-City Remote Trends Continue to Affect Office Vacancy Rates

CommercialEdge, Santa Barbara, Calif., reported that due to a variance in remote and hybrid work, some cities’ office markets remain more vulnerable than others, affecting metrics such as vacancy rates, rental prices, sales and pipelines.

Dealmaker: Newmark Secures $947M for Park La Brea Apartments in Los Angeles

Newmark Group, New York, secured a $947 million loan for Los Angeles' Park La Brea, the largest apartment community on the West Coast.

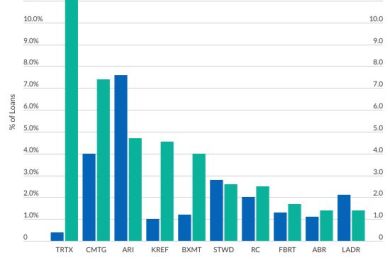

Fitch: Commercial mREIT Sector Faces Further Pressures in 2023

Fitch Ratings, New York, said commercial mortgage real estate investment trust ratings will continue to be challenged by post-pandemic occupancy rates, “with growing recessionary risks and further deterioration of commercial real estate fundamentals.”

MBA Education Webinar Office Doldrums: Challenges, Opportunities and Nuances July 24 (New Date)

Office markets and performance are on the minds of market participants as technology layoffs and space reduction announcements drive the year’s news cycles along with rising interest rates. Join MBA Education and industry practitioners as they explore opportunities and challenges in the office sector.