City-by-City Remote Trends Continue to Affect Office Vacancy Rates

(Courtesy CommericalEdge)

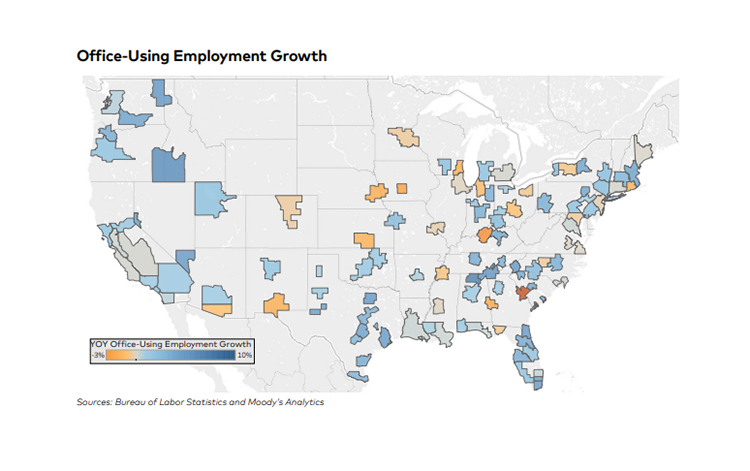

CommercialEdge, Santa Barbara, Calif., reported that due to a variance in remote and hybrid work, some cities’ office markets remain more vulnerable than others, affecting metrics such as vacancy rates, rental prices, sales and pipelines.

In terms of cities where a large share of remote workers is correlated with a higher vacancy rate, CommercialEdge cited as an example the Denver metro area, which has 27.5% of workers working remotely and a 3% increase in vacancy rates over the last year. Portland, Ore., has very similar numbers. Also listed were Austin, Texas; San Francisco; Seattle and the Twin Cities metro area.

The national vacancy rate has climbed 30 basis points year-over-year to stand at 17%. That comes amid continued debates and shifting policies on remote and hybrid work. Currently Kastle Systems, Falls Church, Va., reports 10-city weekly office building occupancy at 49.7%, based on access control data among its business partners and operations.

Overall, the average U.S. office listing rate was at $38.36 per square foot, up 2.1% year-over-year. However, the national average sales price fell 22% from 2022 to 2023, from $250 per square foot to $195 per square foot. One of the hardest hit markets for sales was Los Angeles, where prices fell 43% year-over-year.

Under-construction office space reached 116.2 million square feet nationwide, accounting for 1.8% of total stock .

CommercialEdge pinpointed some other regional and sector-specific trends. For one, the life sciences sector is performing well and remains attractive to investors. It’s a type of work that largely cannot be done remotely, and the construction of more than 120 buildings with at least some life science components is underway nationwide. The top markets are Boston, San Francisco, the Bay Area and San Diego.