Boxwood Means Finds Promising Results for Small-Cap Retail in Q2

(Image courtesy Boxwood Means)

Boxwood Means, Stamford, Conn., found small-cap retail flourished in Q2, per an analysis of CoStar occupancy data involving retail buildings under 50,000 square feet.

For example, tenant demand picked up for the sector. The string of positive net absorption has hit 11 consecutive quarters, since the beginning of the COVID-19 pandemic, Randy Fuchs, Boxwood Means Principal and Co-Founder, said. While the 6.9 million square feet of Q2 net occupancy gains declined 51% compared with last year, demand rose 21% sequentially.

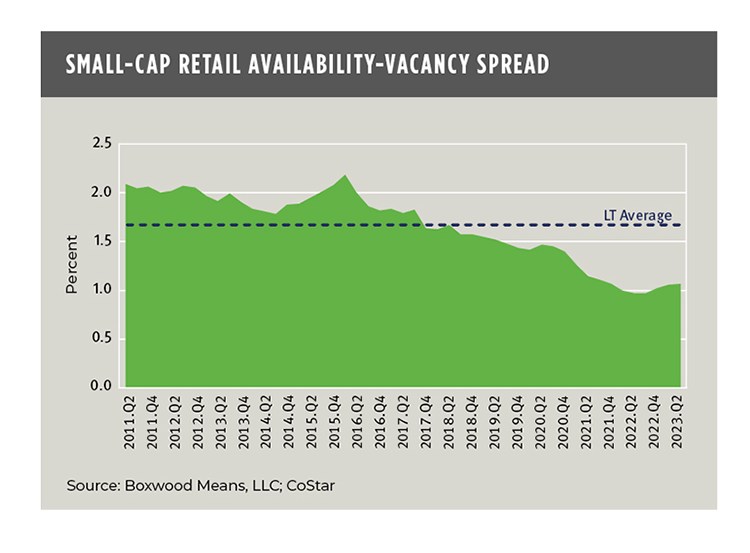

Space availability continues to be quite low, with the national availability rate at a low of 4.5% and 250 basis points below the long-term average. Sublease space remained flat at 0.2% of total U.S. small cap retail inventory.

The direct space national vacancy rate (not including marketable sublet space or rental units with expiring leases) was at 3.5%, 200 basis points under the historical average.

“The very thin spread of 110 bps between the total national availability and vacancy rates indicates affirmatively to lenders and investors that small-cap retail occupier trends have strong, positive momentum,” Fuchs said.

Additionally, rents have grown 2.2% through June and 3.9% year-over-year, putting them in line with advances pre-pandemic.

One factor in small-cap retail’s success may be that it’s able to satisfy routine needs of local shoppers. As more people split their time between office-heavy areas and the suburbs and neighborhoods in which they live, businesses located in the latter areas are receiving an influx of traffic.

Additionally, generally improving economic conditions–such as lessening inflation–have benefited retail.