Boxwood Means, Stamford, Conn., found small-cap retail flourished in Q2, per an analysis of CoStar occupancy data involving retail buildings under 50,000 square feet.

Tag: Randy Fuchs

Slowing Economy Reaches Small-Cap Commercial Real Estate

Boxwood Means LLC, Stamford, Conn., said weaker economic conditions on Main Street are impeding small-cap commercial real estate.

The Sky Isn’t Falling for Small-Cap Commercial Real Estate

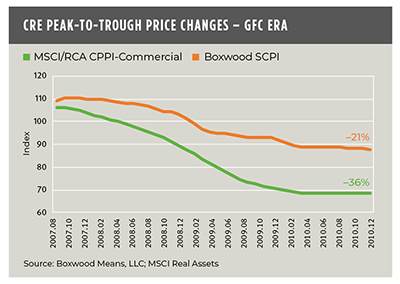

Small-cap commercial real estate appears to be in better shape than the larger CRE market, reported Boxwood Means LLC, Stamford, Conn.

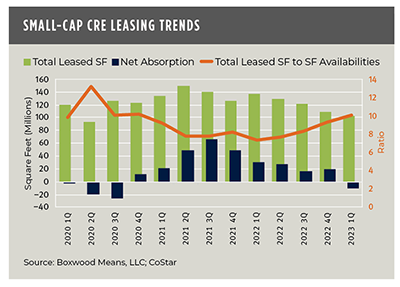

Small-Cap Real Estate Conditions Dim

Small-cap commercial real estate market conditions have dimmed–and things will likely get worse before they get better, reported Boxwood Means LLC, Stamford, Conn.

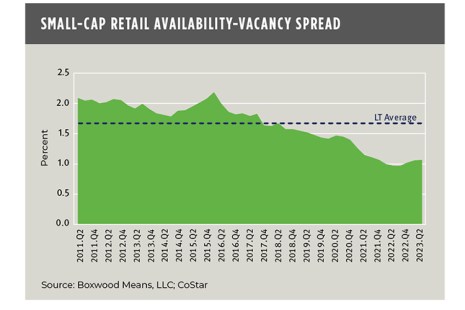

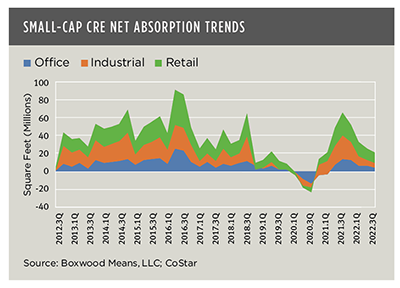

Small-Cap Real Estate Leasing Conditions Waver

Boxwood Means LLC, Stamford, Conn., said current stability of small-cap commercial real estate leasing conditions could be at risk.

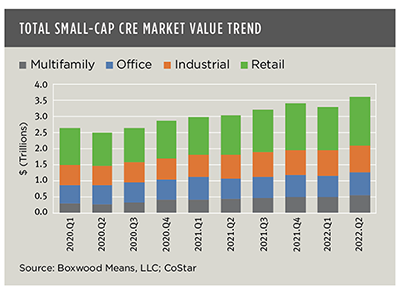

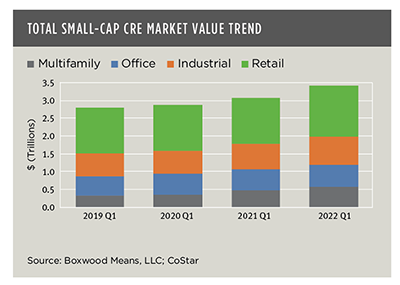

Small-Cap Commercial Real Estate Market Up 19% YoY

Boxwood Means LLC, Stamford, Conn., reported the aggregate market value of small commercial real estate assets rose steadily at midyear despite an increasingly uncertain outlook for commercial real estate prices and the economy.

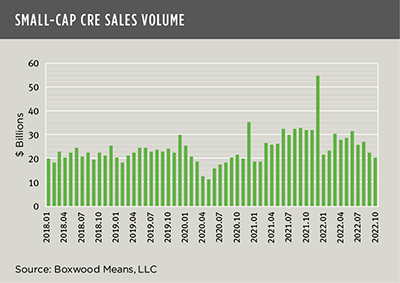

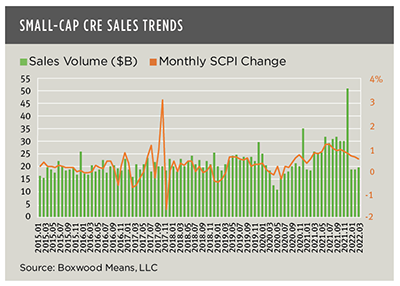

Hot Small-Cap Commercial Real Estate Market Shows Signs of Cooling

Boxwood Means LLC, Stamford, Conn., reported the robust growth in small-cap commercial real estate investments grew sluggish during the first quarter after record-breaking property sales and soaring prices last year.

Small-Cap CRE Market Value Reaches $3.4T

The small-cap commercial real estate market has grown to $3.4 trillion in dollar value, reported Boxwood Means LLC, Stamford, Conn.

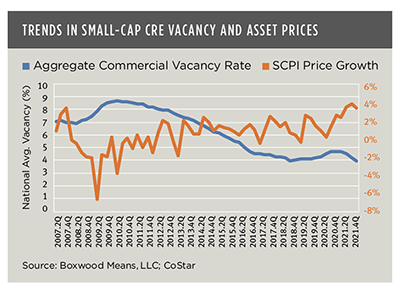

Small-Cap CRE Prices ‘Rationally Tracking’ Fundamentals

Small-cap commercial real estate prices have accelerated at an unprecedented rate but are not overinflated, reported Boxwood Means LLC, Stamford, Conn.

Remote Work Boosts Small Multifamily Asset Prices in Smaller Cities

As the pandemic recedes, small multifamily markets have resumed price growth at an accelerated pace, reported Boxwood Means LLC, Stamford, Conn.