MBA CREF Outlook Survey: Unsettled Markets to Dissipate in 2023

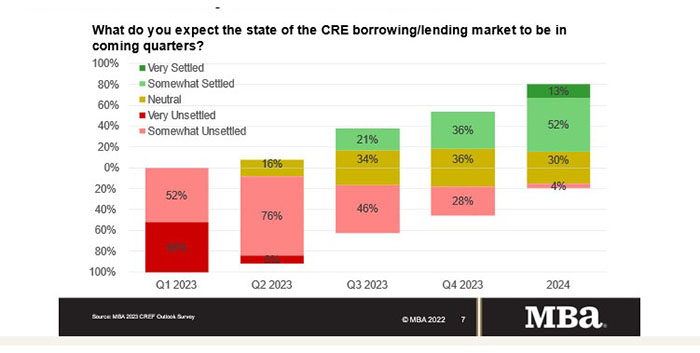

Commercial and multifamily mortgage originators are experiencing an unsettled market for borrowing and lending but anticipate those conditions will slowly stabilize over the course of this year, the Mortgage Bankers Association’s 2023 Commercial Real Estate Finance Outlook Survey found.

“Commercial real estate markets are entering 2023 amid a great deal of uncertainty and, as a result, a significant slowdown in activity,” said Jamie Woodwell, MBA Head of Commercial Real Estate Research. “Leaders of top commercial real estate finance firms believe that overall uncertainty will dissipate over the course of the year, but with a host of factors that will drag–rather than boost–the markets in 2023.”

Woodwell noted the factors most viewed as negative by CRE leaders include office market fundamentals, short-term interest rates, inflation, long-term interest rates, the broader economy, and adjustable rate and short-term loans maturing in today’s market. “Industrial and apartment market fundamentals and changes in the severity of the COVID-19 pandemic are the only factors seen by more leaders as positive than negative for the market,” he said.

Highlights of MBA’s 2023 CREF Outlook Survey include:

• Every survey respondent considers today’s market either somewhat or very unsettled.

• Among property types, the office market is viewed as most negatively affecting today’s borrowing and lending markets while a majority of respondents view the industrial market outlook as having positive impacts.

• Cap rates and valuations, base interest rates and mortgage spreads are all viewed as having negative impacts on today’s financing activity.

• Originators expect the market to stabilize over the course of 2023.

• In 2023, lenders are expected to have a (slightly) stronger appetite to lend than borrowers will have to borrow.

• Borrowing and lending volumes are expected to decline in 2023.

• No capital sources are broadly expected to see increases.

• There are more deals looking for debt than there is debt looking for deals.

• Across a variety of factors affecting the markets, more are seen as negative than positive for 2023.

The 2023 MBA CREF Outlook Survey was conducted between November 30 and December 15, 2022. The survey request was sent to leaders at 55 of the top commercial and multifamily mortgage origination firms, as determined by MBA’s 2021 Annual Origination Rankings Report. The survey had a 46 percent response rate. Percentages shown are calculated based on applicable responses. Non-responses and “n.a.” responses are excluded from the percentage denominator.

Detailed survey results are available to MBA members at www.mba.org/crefresearch.