Even though many commercial real estate loans are long-lived, there’s a sense that the industry starts each year fresh. Sometimes, that means losing credit for all the deals and successes of the previous twelve months. Sometimes – like now – it means being able to put last year in the rearview mirror.

Tag: MBA CREF Outlook Survey

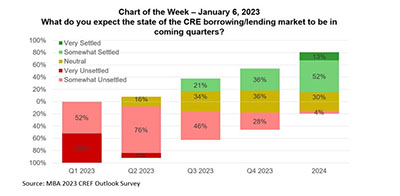

MBA Chart of the Week Jan. 6, 2023: CRE Lending/Borrowing

Commercial real estate markets are entering 2023 amid a great deal of uncertainty and, as a result, a significant slowdown in activity. Leaders of top commercial real estate finance firms believe that overall uncertainty will dissipate over the course of the year, but with a host of factors that will drag – rather than boost – the markets in 2023.

MBA Chart of the Week Jan. 6, 2023: CRE Lending/Borrowing

Commercial real estate markets are entering 2023 amid a great deal of uncertainty and, as a result, a significant slowdown in activity. Leaders of top commercial real estate finance firms believe that overall uncertainty will dissipate over the course of the year, but with a host of factors that will drag – rather than boost – the markets in 2023.

MBA CREF Outlook Survey: Unsettled Markets to Dissipate in 2023

Commercial and multifamily mortgage originators are experiencing an unsettled market for borrowing and lending but anticipate those conditions will slowly stabilize over the course of this year, the Mortgage Bankers Association’s 2023 Commercial Real Estate Finance Outlook Survey found.