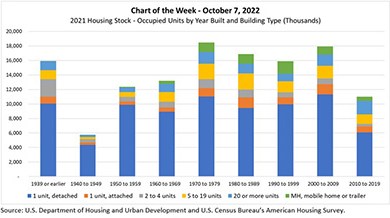

MBA Chart of the Week Oct. 13, 2022: 2021 Housing Stock

At the end of September, HUD and the Census Bureau released 2021 American Housing Survey summary table estimates in the AHS Table Creator and 2021 AHS National and Metro Public Use File microdata. The AHS, last updated with 2019 data, is the “most comprehensive national housing survey in the United States,” and provides information about the quality and cost of housing, including data on “the physical condition of homes and neighborhoods, the costs of financing and maintaining homes, and the characteristics of people who live in these homes.”

MBA CREF Policy Update Oct. 13, 2022

Commercial and multifamily developments and activities from MBA relevant to your business and our industry.

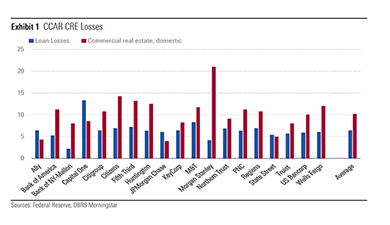

DBRS Morningstar: Federal Reserve Finds CRE Risk

The good news: all 34 banks the Federal Reserve’s recent stress tests examined passed. The not-so-good news: the tests found potential risks in certain loan portfolios including commercial real estate, said DBRS Morningstar, New York.

Commercial and Multifamily People in the News Oct. 13, 2022

Personnel News from CBRE, JLL and Newmark.

Net Lease Cap Rates Increase

The Boulder Group, Wilmette, Ill. said single-tenant net lease property cap rates increased slightly for all three asset classes in the third quarter as debt costs increased.

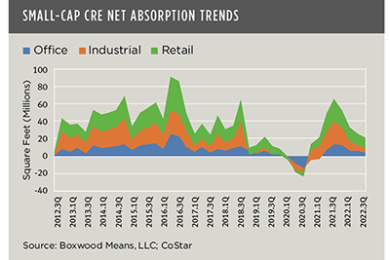

Small-Cap Real Estate Leasing Conditions Waver

Boxwood Means LLC, Stamford, Conn., said current stability of small-cap commercial real estate leasing conditions could be at risk.

Yardi: Reshoring Trend Will Reshape Industrial Real Estate

Recent events have led U.S. firms to produce more goods domestically, which will likely “reshape” the domestic industrial sector, according to Yardi Matrix, Santa Barbara, Calif.

Commercial/Multifamily News Briefs Oct. 13, 2022

News in brief from Merchants Capital, Blackstone, Bluerock Capital and Savills.