Yardi: Reshoring Trend Will Reshape Industrial Real Estate

Recent events have led U.S. firms to produce more goods domestically, which will likely “reshape” the domestic industrial sector, according to Yardi Matrix, Santa Barbara, Calif.

“In recent years, U.S. manufacturers have become well acquainted with the risks involved in making goods abroad,” Yardi said in its Industrial Rent, Occupancy and Supply report. “Not only did the pandemic stress supply chains but other risks posed by U.S. tensions with China over Taiwan, the war in Ukraine and climate change all can jeopardize a firm’s operations. Consequently, many businesses are exploring reshoring production of goods to the U.S.”

The report noted the semiconductor industry has already started the process, which will encourage more U.S. manufacturing because semiconductors are critical components of countless products. “The CHIPS Act passed by Congress and signed into law by President Biden this summer will allocate $53 billion in funding to support domestic semiconductor manufacturing,” Yardi said. “Beyond chip manufacture, the Biden administration has committed billions to increase domestic supply-chain resiliency, and the Inflation Reduction Act incentivizes stateside production of renewable energy products, further boosting the long-term outlook of U.S. manufacturing.”

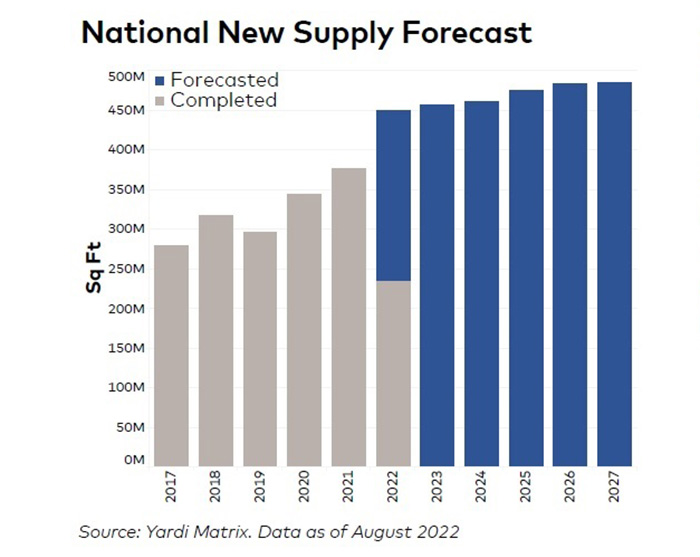

But manufacturers that bring their production back to the U.S. will face a unique set of challenges, the report said. “Not only will they need industrial space to manufacture goods but logistics and distribution facilities, as well. With a national vacancy rate of just 4.1%, space may be hard to come by.”

In addition, the current tight labor market means site selection will depend on labor pools as well as infrastructure. “American labor costs are also much higher than in places where manufacturing has been offshored, meaning firms will explore automation solutions and likely increase costs for their products to strike a balance,” Yardi said. “Production and supply chains are complex systems that take years to reshape; reshoring is not a ‘quick fix’ for firms struggling in the current global economy. We expect that reshoring will continue during this decade, albeit at a slow pace, and be a driver of industrial real estate demand for years to come.”

The report said national in-place rents for industrial space averaged $6.64 per foot in August, up 5.5% over the last 12 months. Rents grew the most in port markets, where record activity and supply-chain bottlenecks are driving demand. California’s Inland Empire, Boston, Los Angeles and New Jersey all saw 7-plus percent year-over-year rent growth.