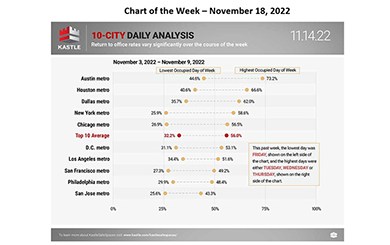

MBA Chart of the Week Dec. 1, 2022: Return to Office Rates

Thanks to a very tight labor market and technological advances, hybrid work reigns two and a half years after the onset of the COVID-19 pandemic, with employees at many companies coming into the office a few days a week. The extent to which this trend will continue – and what it means for the office market – will depend on employees’ and employers’ costs and benefits of being in the office versus remote and whether a transition to a looser labor market tilts the bargaining table to employers and their preference for more in-person collaboration.

MBA CREF Policy Update Dec. 1, 2022

Commercial and multifamily developments and activities from MBA relevant to your business and our industry.

#CREF23: Navigating Economic Uncertainty With Roger Ferguson

Economist, corporate executive and finance expert Roger Ferguson will open the MBA Commercial/Multifamily Finance Convention & Expo in February.

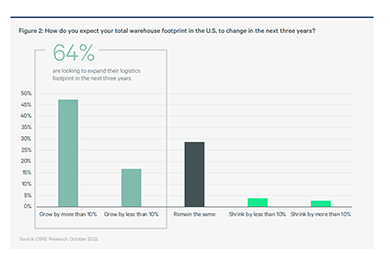

CBRE: Industrial Occupiers Still in Expansion Mode

Strong industrial market demand will likely continue, though not at the record pace set in 2021, said CBRE, Dallas.

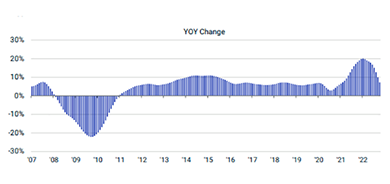

October Commercial Property Prices Fall

Real Capital Analytics, New York, reported U.S. commercial property prices fell in October--though they remain higher than a year ago.

Austin, D.C., Raleigh Lead STEM Job Growth Index

RCLCO Real Estate Consulting, Bethesda, Md., announced its annual index measuring strongest metro areas for growth in STEM job growth (Science, Technology, Engineering and Math), showing Austin, Texas as the top-ranked market.

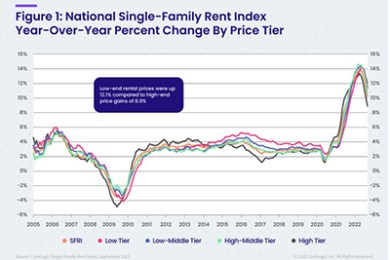

CoreLogic: Single-Family Rent Growth Down 5th Straight Month

CoreLogic, Irvine, Calif., said year-over-year single-family rent growth slowed for the fifth consecutive month in September to 10.2%, down from a high of 13.9% in April. Additionally, rent growth this September fell below that of a year ago.

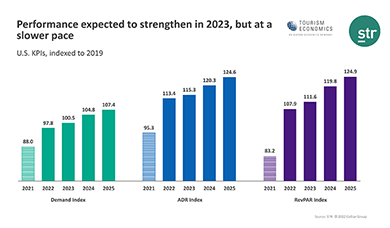

Hotel Analysts Lower Occupancy Forecast, Maintain Revenue Projections

STR, Hendersonville, Tenn., and Tourism Economics, Wayne, Pa., lowered their hotel occupancy forecast slightly but maintained previous projections for revenue per available room and average daily room rates.

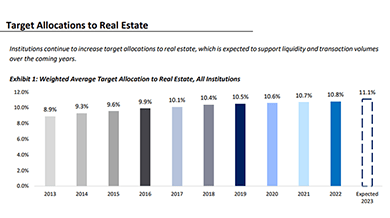

Investors Increase Real Estate Target Allocations

Institutional investors continue to increase their target allocations to real estate and expect attractive buying opportunities to emerge over the next several years, reported Hodes Weill & Associates and Cornell University in their annual Institutional Real Estate Allocations Monitor.