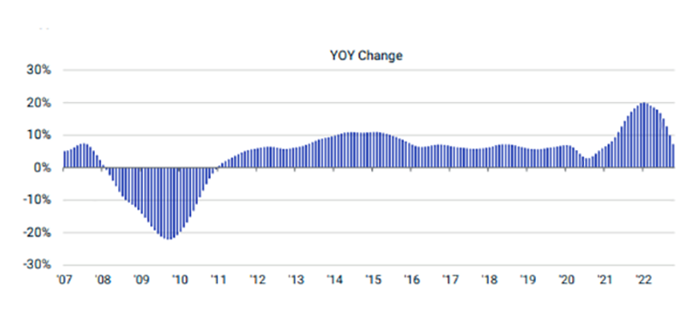

October Commercial Property Prices Fall

Real Capital Analytics, New York, reported U.S. commercial property prices fell in October–though they remain higher than a year ago.

The RCA CPPI National All-Property Index dropped 0.4% in October. Property prices stand 7.3% higher than a year ago.

“Most property type indexes showed monthly declines and all showed slowing annual growth rates in October,” said RCA Senior Analyst Michael Savino. “Pricing has come under pressure amid a spike in debt costs and a slowdown in deal activity in 2022.”

Savino noted commercial real estate sales volume fell at a double-digit rate in October, the third straight month of significant annual declines.

RCA reported apartment asset prices declined 0.6% in October. This monthly decline would total 7.0% in annualized. Retail asset prices fell 0.3% as their annual pace of growth slowed to 8.2%. “Both sectors reached record annual rates of price growth early in 2022,” RCA said.

The industrial sector index outperformed with a 0.7% monthly gain; a 16.9% annual growth rate. But the sector’s annual pace has decelerated for seven consecutive months, the report noted.

Prices for suburban office assets rose just 0.1% in October. The central business district office index posted another monthly decline, falling 0.3%.

RCA reported annual price growth in the six largest U.S. metros–Boston, Chicago, Washington, D.C., Los Angeles, New York and San Francisco–slowed further in October, slipping to just a 0.8% gain; on the month, prices fell 0.8%. Price growth in non-major metros decelerated to a 9.9% rate and prices held steady in October.

Green Street, Newport Beach, Calif., reported its price index of commercial properties owned by real estate investment trusts decreased by 7% in October.

“It’s a simple story: higher yields on Treasury bonds equals higher cap rates,” said Peter Rothemund, Co-Head of Strategic Research at Green Street. “And as large as the decline in pricing has been, I don’t think we’re out of the woods. If the 10-year note stays above 4%, property prices are likely to keep falling.”

Green Street said rising interest rates have caused the property prices it tracks to decline by 13% this year.