MBA: Commercial, Multifamily Mortgage Bankers Originated $683B in 2021; Total Lending Tally Reaches $891B

Commercial and multifamily mortgage bankers closed $683.2 billion of loans in 2021, the Mortgage Bankers Association reported Thursday. MBA estimated total CRE lending including activity from smaller and mid-sized depositories totaled $890.6 billion.

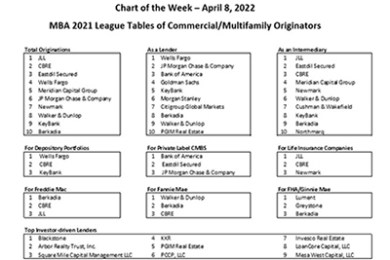

MBA Chart of the Week: Top Commercial/Multifamily Originators

MBA's Commercial Real Estate/Multifamily Finance Firms - Annual Origination Volumes annual report presents a comprehensive set of listings of commercial/multifamily mortgage originators, their volumes and the different roles they play. The report presents origination volumes in more than 140 categories, including by role, by investor group, by property type, by financing structure type and by location of the originating office.

CREF Policy Update April 14, 2022

Commercial and multifamily developments and activities from MBA relevant to your business and our industry.

CMBS Delinquency Rate Maintains Downward Trajectory

The commercial mortgage-backed securities delinquency rate fell 10 basis points during March to 2.38 percent, driven by robust new issuance and few new delinquencies, reported Fitch Ratings, New York.

Digitalization, Demographics, Deglobalization Redefine Industrial Real Estate

Digitalization, demographics and deglobalization will drive the industrial market growth in the near future, said Newmark, New York.

Eli Moghavem of Base Equities: Small-Balance Preferred Equity Helps Sponsors Compete for Middle-Market Opportunities

In this article, we explore preferred equity investments serving small-to-mid transaction sizes, where there can be a win-win-win for sponsors, investors and the capital markets brokerage community.

Personnel News From JLL, NorthMarq, Eastern Union

JLL Valuation Advisory hired Katie Parsons as Managing Director – Head of Industrial Property Sector, where she will focus on driving growth, building the industrial platform, enhancing the customer experience and providing value to clients.

MISMO Calls for Participants to Develop a Roadmap for a Commercial eNote Standard

MISMO®, the real estate finance industry standards organization, issued a call for participants for a new Development Workgroup focused on exploring industry interest and demand for creating a standard for Commercial electronic promissory notes (eNotes).

Commercial Construction Costs Continue to Escalate

Commercial real estate construction costs continue to increase, reported Rider Levett Bucknall, Honolulu.