CREF Policy Update May 27, 2021

Commercial and multifamily developments and activities from MBA relevant to your business and our industry.

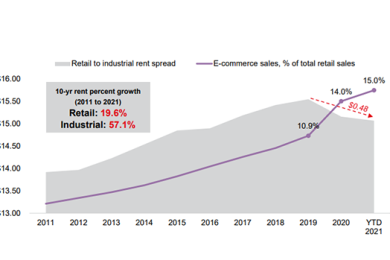

Spread Between Retail, Industrial Rents Compresses

JLL, Chicago, reported the spread between retail property rents and industrial property rents is compressing as home deliveries speed up and e-commerce steals more and more market share from brick-and-mortar retailers.

1Q Distressed CRE Debt Drops

More U.S. commercial real estate distress was worked out than arose in the first quarter, sector analysts reported.

ULI: CRE ‘Poised for a Rebound’

A panel of 42 real estate economists said commercial real estate is “poised for a rebound,” the Urban Land Institute reported.

Peter Muoio of SitusAMC Insights: Migration Out of Big Cities Opportunity for Some Who Previously Couldn’t Afford It

Peter Muoio is head of SitusAMC’s Insights division, a provider of technology and services to the real estate finance industry. He has more than 30 years of research and analytics experience in the commercial real estate industry.

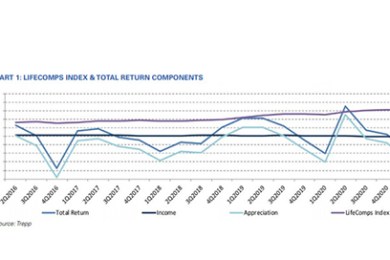

LifeCo Commercial Mortgage Return Index Dips

Trepp, New York, said commercial mortgage investments held by life insurance companies dipped in the first quarter after three consecutive positive quarters.

Dealmaker: Meridian Capital Group Arranges $172M For Newly Constructed Multifamily

Meridian Capital Group, New York, arranged $171.6 million to refinance newly constructed multifamily property One Museum Square in Los Angeles, on behalf of JH Snyder Co., Los Angeles.

Commercial/Multifamily Briefs from Freddie Mac, Canyon Partners

Freddie Mac, McLean, Va., priced a new offering of Structured Pass-Through K Certificates that included a class of floating-rate bonds indexed to the Secured Overnight Financing Rate.