CREF21: MBA Chair Susan Stewart on ‘3 Values that Unite the Industry’

Mortgage Bankers Association Chair Susan Stewart said regardless of industry focus—residential or commercial—real estate finance comes down to three values that unite the industry.

CREF21: Bob Broeksmit on ‘The MBA Difference’

Mortgage Bankers Association President & CEO Robert Broeksmit, CMB, opened the MBA CREF21 Convention & Expo by recapping the “unprecedented challenges” the real estate finance industry faced over the past year and a look at the uncharted waters ahead.

MBA CREF 2021: A Conversation with GSE Leadership

One year ago, almost no one could have predicted what 2020 would bring. Everyone in the real estate world had to adjust their expectations.

mPower: Remaining Resilient Amid Disruption

The pandemic has increased stress on everyone and everything. So MBA CREF21 asked several female business leaders to discuss lessons they have learned while navigating COVID-19 challenges.

Addressing America’s Affordability Crisis

Moody’s Analytics and the Urban Institute recently reported that more than 10 million U.S. renter households owe more than $5000 in back rent and fees as America’s affordability problem worsens during the pandemic. Analysts took on these and other issues in a lively session at the Mortgage Bankers Association's CREF21 virtual convention.

CRE Performance, Outlook Varies by Bucket

Investors and lenders are grouping commercial properties into distinct “buckets,” and different buckets will likely perform differently as the economy bounces back from the Pandemic Recession, said MBA Vice President of CRE Research & Economics Jamie Woodwell.

MBA Forecast: 2021 Commercial/Multifamily Lending to Increase 11% to Nearly $500 Billion

The Mortgage Bankers Association expects commercial and multifamily mortgage bankers to close $486 billion in loans backed by income-producing properties in 2021, an 11 percent increase from 2020’s estimated $440 billion, according to its latest forecast.

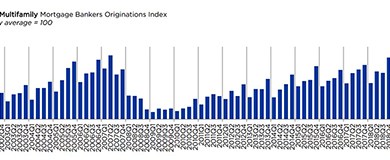

MBA: 4th Quarter Commercial/Multifamily Borrowing Falls 18 Percent

Commercial and multifamily mortgage loan originations fell by 18 percent in the fourth quarter from a year ago, but increased by 76 percent from the third quarter, according to the Mortgage Bankers Association’s Quarterly Survey of Commercial/Multifamily Mortgage Bankers Originations.

MBA: 2021 Commercial/Multifamily Mortgage Maturity Volumes to Increase 36%

The Mortgage Bankers Association says $222.5 billion of the $2.3 trillion (10 percent) in outstanding commercial and multifamily mortgages held by non-bank lenders and investors will mature in 2021, a 36 percent increase from the $163.2 billion that matured in 2020.

MBA Presents Byron Boston with 2021 CREF Distinguished Service Award

The Mortgage Bankers Association awarded Byron Boston, CEO, President and Co-Chief Investment Officer of Dynex Capital Inc., Glen Allen, Va., with the 2021 Commercial Real Estate Finance Distinguished Service Award at its MBA LIVE CREF21: Lending, Investing, Servicing and Technology Convention & Expo.

MBA Presents UBS with Commercial/Multifamily Diversity and Inclusion Leadership Award

The Mortgage Bankers Association presented UBS with the 2021 Commercial/Multifamily Diversity and Inclusion Leadership Award.

Troubled Commercial Mortgage Loan Triage: A Special Servicer Roundtable

With the ebb and flow of 2020 market disruption in the rearview mirror and the vaccine rollout in full swing, MBA NewsLink checked in with a special servicer, a rating agency servicer analyst and Freddie Mac asset management chief to explore what is happening in commercial/multifamily markets, where different parts of the commercial real estate finance ecosystem are today and factors driving the outlook for agency and non-agency CMBS sectors.

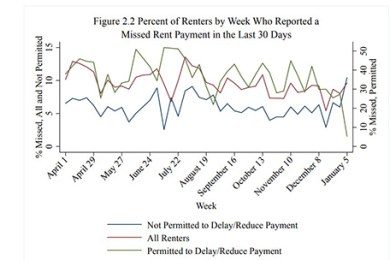

MBA RIHA Study Shows Progress, but 5 Million Renters, Homeowners Missed December Payments

Five million households did not make their rent or mortgage payments in December, and 2.3 million renters and 1.2 million mortgagors believe they are at risk of eviction or foreclosure or would be forced to move in the next 30 days, according to fourth-quarter research released today by the Mortgage Bankers Association's Research Institute for Housing America.

Murky Outlook for Office Sector

The U.S. office sector faces a “murky” future after a tumultuous 2020, said Yardi Matrix, Santa Barbara, Calif.