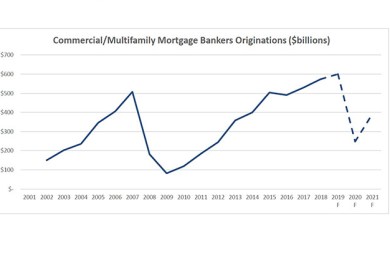

COVID-19 Pandemic to Cause Commercial/Multifamily Lending Pullback in 2020

Commercial and multifamily mortgage bankers are expected to close $248 billion in loans backed by income-producing properties this year, a 59 percent decline from 2019’s record volume of $601 billion, a new Mortgage Bankers Association forecast said.

Andrew Foster: Commercial Observer Power Finance List Stacked with MBA Leadership

The Commercial Observer’s annual listing of commercial real estate finance power players includes some names familiar to MBA members. The list identifies the 50 most powerful figures in commercial real estate finance.

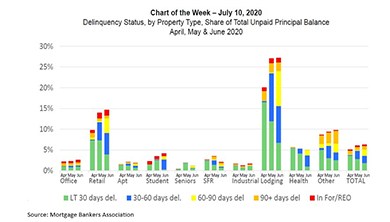

MBA Chart of the Week: Delinquency Status of Unpaid Principal Balance 2nd Quarter

The $3.7 trillion commercial and multifamily mortgage market is really a confederation of different capital sources, property types and geographic markets, all bound together by the provision of mortgage capital backed by investment property incomes and collateral value. Often, the overall market moves in tandem. At other times – like now – different segments act very differently.

CREF Policy Update July 16, 2020

Last week the Life Risk-Based Capital Working Group of the National Association of Insurance Commissioners approved guidance on property valuations for 2020 life company risk-based capital reporting.

Dealmaker: Berkadia Secures $52M for Multifamily

Berkadia secured $51.5 million in Fannie Mae and Freddie Mac funds to refinance multifamily properties in Maryland and Massachusetts.

Fitch Ratings: Coronavirus Sparks Largest-Ever CMBS Delinquencies Rate Jump

June saw the largest month-over-month increase in the commercial mortgage-backed securities delinquency rate in more than 15 years, reported Fitch Ratings, New York.

People: Eastern Union Promotes Lipoff, Merchants Capital Hires George

Eastern Union, Brooklyn, N.Y., promoted Jacob Lipoff to lead the company’s newly centralized QTS Banking and Capital Markets Division.

Survey: Pandemic Forces Nearly Half of Renters to Postpone Homeownership Plans

RentCafe, Santa Barbara, Calif., said its survey of 7,000 renters found although one in 10 renters planned to by a home in 2020, nearly half have now delayed those plans because of the economic impact of the coronavirus pandemic.

Social Responsibility, New Technologies Increase Real Estate Transparency

Greater emphasis on corporate social responsibility and new technologies have improved global real estate transparency over the past two years, JLL and LaSalle reported.

CRE Market Sentiment Plunges

CRE executives’ market sentiment “plunged as expected” in mid-2020, said RCLCO Real Estate Advisors, Washington, D.C.

Hotel Sector Bouncing Back But Faces Continued Threats

CBRE, Los Angeles, said the hotel sector has seen 10 straight weeks of occupancy gains, but the recent COVID-19 diagnosis increase threatens to “derail” its progress.

Commercial/Multifamily Briefs from RealMassive, Walker & Dunlop and Colliers International

RealMassive, Austin, Texas, said it will offer access to its DataQu property data platform at no cost through year-end.