Launched in 2022, the CREF Careers Student Fellowship Program is for students interested in learning more about internships, jobs, and careers in the $4.7 trillion commercial real estate finance industry.

Category: News and Trends

Redfin: Asking Rents Up 0.6% in September

Redfin, Seattle, found asking rents rose by 0.6% year-over-year in September to $1,634. On a monthly basis, they fell 0.2% from August.

Dodge Finds a Dip in Commercial Properties Entering Planning Stage

The Dodge Momentum Index–a measure of the value of nonresidential building projects going into planning–decreased 4.2% in September, and commercial properties entering the planning stage contracted 7.8%, according to the Dodge Construction Network, Bedford, Mass.

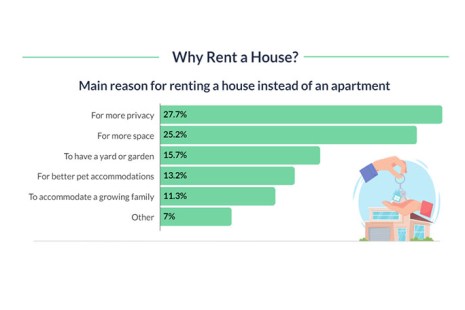

Point2: House Renters Prioritizing Space, Pets, Privacy

Point2, Saskatoon, Saskatchewan, conducted a survey of renters of single-family homes, finding that privacy and space are among the top motivators–but the comfort of their furry friends also ranks high.

RentCafe: In Shift, Detroit Tops List of Most Sought-After City for Renters

RentCafe, Santa Barbara, Calif., released its Rental Activity Report for September, finding Detroit took the top spot.

CREF Policy Update: MBA Responds to HUD Proposal on Loan Disbursements

Commercial and multifamily developments and activities from MBA important to your business and our industry.

Dealmaker: Walker & Dunlop Arranges $137M for Downtown Boston Multifamily

Walker & Dunlop, Bethesda, Md., arranged $137.2 million for LUKA on the Common, a 398-unit, 30-story apartment community in downtown Boston.

CMF Quote of the Week

“There is a stagnant supply of net lease properties on the market resulting from limited transaction activity from both private and institutional buyers.”

–Boulder Group President Randy Blankstein

Yardi Matrix: Fully Affordable Housing Deliveries to Hit Peak in 2025

Yardi Matrix, Santa Barbara, Calif., released a new study on affordable housing, forecasting that deliveries of fully affordable housing will reach 69,600 in 2024 and 70,500 in 2025, before dropping in future years.

RCN Capital: Real Estate Investor Optimism Grows

RCN Capital, South Windsor, Conn., released its Fall 2024 RCN Capital/CJ Patrick Co. Investor Sentiment Index, finding that 68% of real estate investors view today’s market as better or much better than it was a year ago.