COVID-19 has negatively impacted industries across the U.S., with commercial real estate and its financiers no exceptions.

Category: News and Trends

Data Centers Bright Spot in Pandemic Economy

Where some see challenges, others see opportunity–and business data centers proved resilient in the first half of 2020 as many businesses implemented hybrid IT infrastructure to improve their remote work capabilities and streaming content providers saw increased viewership due to the COVID-19 pandemic, said CBRE, Los Angeles.

Dealmaker: Berkadia Closes $31M Apartment Property Sale

Berkadia arranged the $30.6 million sale and financing for Turtle Creek Apartment Homes, a 232-unit garden-style apartment community 15 miles north of downtown Tampa, Fla. Managing Director Jason Stanton from …

Life Insurance Commercial Mortgage Return Index Surges

Commercial mortgage investments held by life insurance companies posted a 4.58 percent total return in the second quarter, a major reversal from the first quarter’s negative 1 percent return, said Trepp LLC, New York.

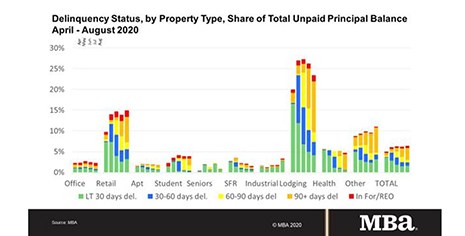

MBA: Pandemic Takes Aim at Commercial, Multifamily Mortgage Delinquency Rates

The coronavirus pandemic had a “dramatic and immediate impact” on delinquency rates for some mortgages backed by commercial and multifamily properties in the second quarter, although most continued to perform well, the Mortgage Bankers Association said today in two reports.

COVID is Accelerating CRE Trends

Kroll Bond Rating Agency, New York, said the COVID-19 pandemic accelerated many commercial real estate trends already in progress.

Longer-Term Challenges to Multifamily Risk Outlook Emerge

The multifamily sector made it through the first half of the year with less turmoil as some anticipated. But the pandemic could create longer-term challenges for the sector, said Phoenix American, San Rafael, Calif.

Dealmaker: Phillips Realty Capital Secures $63M for Texas Multifamily

Phillips Realty Capital, Bethesda, Md., secured $63.2 million for a Class A Plano, Texas multifamily property.

CRE at a Crossroads

The coronavirus pandemic has put commercial real estate “at a crossroads,” said Yardi Matrix, Santa Barbara, Calif.

Office Outlook ‘Opaque’

Reonomy, New York, said the office sector has avoided the worst of the recession, largely due to underlying characteristics including tenant diversification and longer-term leases. But it called the sector’s outlook “opaque.”