Northmarq, Minneapolis, arranged $45.9 million to refinance four Wisconsin and California multifamily properties.

Category: News and Trends

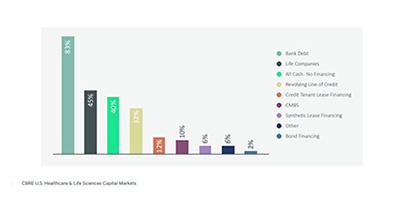

CBRE: Investors Set to Pour More Capital into ‘Recession-Resistant’ Healthcare Sector

CBRE, Dallas, reported investors plan to allocate more capital to healthcare real estate, highlighting rising confidence in the asset class.

The FHFA 2022-2026 Strategic Plan: What It Means for MBA Members

The Federal Housing Finance Agency last week released its 2022-2026 Strategic Plan for Fiscal Years 2022-2026, focusing on guiding Fannie Mae, Freddie Mac and the Federal Home Loan Bank System for the next five years.

STR: Hotel Construction Pipeline Shrinks But Planning Activity Increases

STR, Hendersonville, Tenn., reported hotel rooms under construction fell from one year ago, but noted properties in the planning stage increased significantly.

Commercial and Multifamily Briefs April 22, 2022

Commercial and Multifamily Briefs from BlackStone, Madison Marquette, Highland Square Holdings and Fannie Mae.

mPact Events During MBA NAC 22

The Mortgage Bankers Association’s National Advocacy Conference is back in person, April 26 – 27, in Washington, DC. This is the industry’s largest in-person advocacy event of the year focused solely on the issues facing you and the real estate finance industry.

MISMO Calls for Participants to Develop a Roadmap for a Commercial eNote Standard

MISMO®, the real estate finance industry standards organization, issued a call for participants for a new Development Workgroup focused on exploring industry interest and demand for creating a standard for Commercial electronic promissory notes (eNotes).

Quote

“The rapid rise in interest rates is expected to take some wind out of the sails of new lending activity, but healthy property fundamentals and strong property values should support the markets and keep commercial real estate mortgage demand at strong levels. Borrowing and lending should still match last year’s record levels.”

–Jamie Woodwell, MBA Vice President of Commercial Real Estate Research.

CREF Policy Update April 21, 2022

Commercial and multifamily developments and activities from MBA relevant to your business and our industry.

Personnel News From NorthMarq, Newmark, Grandbridge, JLL

Northmarq hired JoAnn Neau as the company’s first chief marketing officer. Neau joined the firm from Thrivent, where she led digital and marketing operations strategies.