Join thousands of your commercial and multifamily real estate colleagues in San Diego for the MBA Commercial/Multifamily Finance Convention & Expo, Feb 12-15, 2023.

Category: News and Trends

Job Security, Pay Equity, Inclusion Top Considerations for Women in CRE

The CREW Network, Lawrence, Kan., said American workplaces have experienced a significant shift in how employees view work since COVID.

Megan Booth Joins MBA as AVP of Commercial/Multifamily Policy

Megan Booth joined the Mortgage Bankers Association’s Commercial/Multifamily Department as Associate Vice President of Commercial/Multifamily Policy.

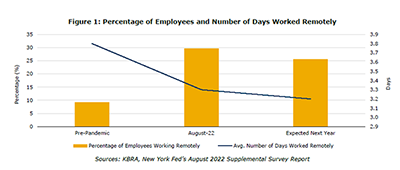

Economic Uncertainty, Remote Work Challenge Office Sector

Despite five interest rate increases in 2022, inflation remains near multi-year highs. This could hit the office sector harder than other property types, said KBRA, New York.

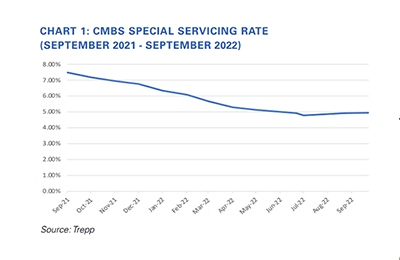

CMBS Delinquency Rate Falls; Special Servicing Rate Increases

The commercial mortgage-backed securities delinquency rate fell slightly in September, offset by an increase in the special servicing rate.

Dealmaker: Transwestern Real Estate Services Closes $41M Office Sale

Transwestern Real Estate Services, Houston, arranged sale of the six-building, 250,588-square-foot Westech Portfolio in Silver Spring, Md.

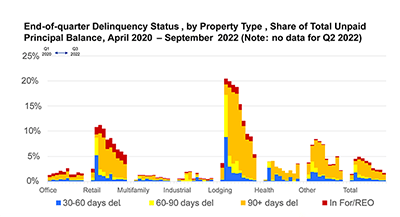

MBA: 3Q Commercial, Multifamily Mortgage Delinquency Rates Decline

Delinquency rates for mortgages backed by commercial and multifamily properties declined through the third quarter, according to the Mortgage Bankers Association’s latest CREF Loan Performance Survey.

MBA Commends FHFA’s New Enterprise Housing Goals Methodology Proposal

The Mortgage Bankers Association commended the Federal Housing Finance Agency for its proposed rule establishing 2023-2024 Multifamily Enterprise Housing Goals for Fannie Mae and Freddie Mac.

Hotel Cap Rates Increase

U.S. Realty Consultants LLC, Columbus, Ohio, reported hotel capitalization rates generally increased compared to six months ago.

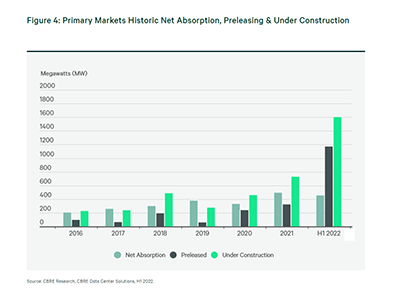

CBRE: Record Low Data Center Vacancies Despite Increased Supply in H1 2022

The North American data center market added significant new supply this year, but overall vacancy declined to a record low, reported CBRE, Dallas.