CMBS Delinquency Rate Falls; Special Servicing Rate Increases

The commercial mortgage-backed securities delinquency rate fell slightly in September, offset by an increase in the special servicing rate.

Fitch Ratings, New York, reported the CMBS delinquency rate fell two basis points to 1.95% in September as resolutions and steady new issuance continued.

“However, Fitch anticipates the pace of delinquency improvement to wane with growing macroeconomic concerns affecting refinance activity and resolution velocity,” Fitch said in its latest CMBS Commentary. “These concerns include rising interest rates, high inflation and slowing economic growth, as well as the prospect of the U.S. entering a mild recession in mid-2023. Reduced CMBS issuance volumes will also negatively affect the rate.”

September resolutions totaled $712 million, down from $1.1 billion in August, Fitch reported. New 60-plus-day delinquencies ticked up to $678 million in September from $657 million in August led by loans secured by retail properties (77%; $521 million). Nearly 90% of the new 60-plus-day delinquencies were maturity defaults.

Fitch said it now anticipates the year-end 2022 delinquency rate to be at least 1.75%, up from its 1.25% forecast from early 2022.

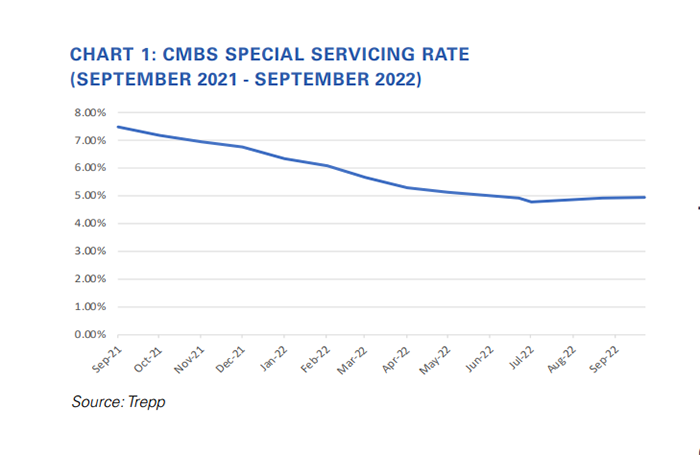

Trepp LLC, New York, said the CMBS special servicing rate rose for the second time in two months in September. The rate rose two basis points to 4.94%. The rate equaled 7.48% one year ago.

“This is the first time the rate has increased in consecutive months since August and September of 2020,” said Jack LaForge, Research Associate with Trepp. “September data revealed declines in the rate for four of the five major commercial real estate property types.”

LaForge noted the office sector saw a 26-basis point increase, “and the volume of retail loans in special servicing remained high,” he said.

Trepp reported $1.1 billion in CMBS debt transferred to a special servicer in September. Office transfers made up 57% of the newly transferred balance; retail transfers ranked second at 30%.

S&P Global Ratings, New York, said U.S. CMBS ratings likely avoided Hurricane Ian’s path. “While it is too early to assess the full impact of Hurricane Ian on S&P Global Ratings-rated U.S. CMBS, broad rating downgrades relative to the properties located in the impacted areas appear unlikely,” S&P said. “This is based on the initial (mostly visual) evidence that we have been able to gather so far, combined with our CMBS industry standards typically requiring borrowers to maintain adequate insurance coverage, especially when assets are in zones considered at risk.”