‘Coronavirus Effect’ Takes Aim at March Housing Starts

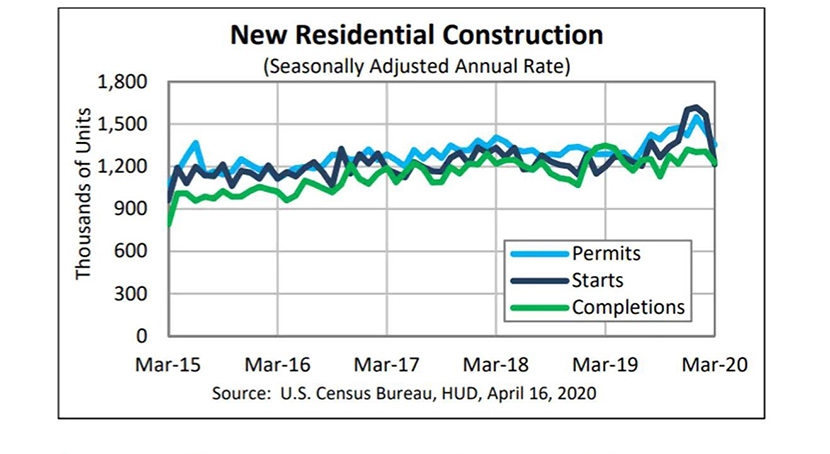

The economic effects of the coronavirus pandemic showed up in March housings starts, which fell by more than 22 percent, HUD and the Census Bureau reported yesterday.

The report said privately owned housing starts in March fell to a seasonally adjusted annual rate of 1.216 million, 22.3 percent below the revised February estimate of 1.564 million, but 1.4 percent higher than a year ago (1.199 million). Single‐family housing starts in March fell to 856,000; 17.5 percent below the revised February figure of 1.037 million. The March rate for units in buildings with five units or more fell to 347,000, down by 32.1 percent from February’s revised 511,000 and down by nearly 4 percent from a year ago.

Regionally, starts fell across the board. In the largest region, the South, starts fell by 21.3 percent to 693,000 units, seasonally annually adjusted, from 881,000 units in February but improved by nearly 6 percent from a year ago. In the West, starts fell by 18.2 percent in March to 301,000 units from February’s revised 368,000 and fell by 8.5 percent from a year ago.

In the Midwest, starts fell by 21.5 percent to 153,000 units, seasonally annually adjusted, from February’s revised 195,000 but improved by nearly 16 percent from a year ago. In the Northeast, starts fell by 42.5 percent in March to 69,000 units from February’s revised 120,000 units and fell by nearly 17 percent from a year ago.

“Housing starts fell in March, led by a particularly sharp drop in multifamily building,” said Mike Fratantoni, Chief Economist with the Mortgage Bankers Association. “Construction activity declined across the country, but was particularly weak in the Northeast, which makes sense given the severe impact of the pandemic in New York.”

Fratantoni noted construction activity was running strong in the first two months of 2020, and even with March’s decline, single-family starts were 2.8% ahead of last year’s pace, and building overall remained 1.4% higher. “Similarly, permits declined for the month, but single-family remained ahead of last year’s pace, indicating that plans for building will continue, despite the sharp drop in economic activity occurring in the second quarter,” he said. “Overall, March’s downshift in the pace of building aligns with this week’s MBA report on mortgage applications for new home purchases.”

Odeta Kushi, Deputy Chief Economist with First American Financial Corp., Santa Ana, Calif., said March’s results, combined with a 42-point drop this week in the National Association of Home Builders’ Housing Market Index, shows home building is reacting to the coronavirus pandemic.

“[Wednesday’s] homebuilder survey posted its largest one-month decline on record as all three components fell: expected future sales, present sales and buyer traffic,” Kushi said.

“Prior to the pandemic, builders were already faced with several supply-side headwinds: increasing material costs, a chronic lack of construction workers, a dearth of buildable lots, and restrictive regulatory requirements in many markets. Now, those headwinds remain, but builders must also grapple with temporary reduced demand from a struggling labor market and ‘shelter-in-place’ orders.”

Kushi said March’s housing starts data reveals the early signs of the impact that the COVID-19 pandemic is having on the new home market and confirms the hesitancy on the part of builders, as housing permits, starts, and completions fell on a month-over-month basis. “Once health fears subside and the economy re-opens, it will be a slow climb,” she said. “The industry will continue to deal with the job losses, tightened credit and economic damage, but the fundamentals that drive new home sales — near record-low mortgage rates, a limited supply of existing homes for sale and sturdy demand driven by millennials aging into homeownership, will begin to boost the market once more.”

Mark Vitner, Senior Economist with Wells Fargo Securities, Charlotte, N.C., said although home building is not at the center of the current economic storm, demand for single-family homes and apartments will certainly be impacted by the sharp pullback in overall economic activity and the spike in the unemployment rate.

“Inventories of completed single-family homes remain exceptionally lean but prospective buyer traffic has dried up, which will likely keep builders cautious,” Vitner said. “The single-family market fell more than expected in March. Milder than usual weather allowed more homes to be started in the normally slow winter period, which meant starts rose less than usual in March.”

HUD/Census said privately owned housing units authorized by building permits in March fell to a seasonally adjusted annual rate of 1.353 million units, 6.8 percent below the revised February rate of 1.452 million but 5 percent higher than a year ago (1.288 million). Single‐family authorizations in March fell to 884,000; 12 percent

below the revised February figure of 1.005 million. Authorizations of units in buildings with five units or more rose to 423,000 in March, up by 5.2 percent from February’s revised 402,000 but 3.6 percent lower than a year ago.

The report said privately owned housing completions in March fell to a seasonally adjusted annual rate of 1.277 million, 6.1 percent below the revised February estimate of 1.307 million and 9 percent lower than a year ago (1.348 million). Single‐family housing completions in March fell to 863,000; 15 percent below the revised February rate of 1.015 million. The March rate for units in buildings with five units or more rose to 357,000, up by 26.1 percent from February’s revised 283,000 but down by 4.3 percent from a year ago.