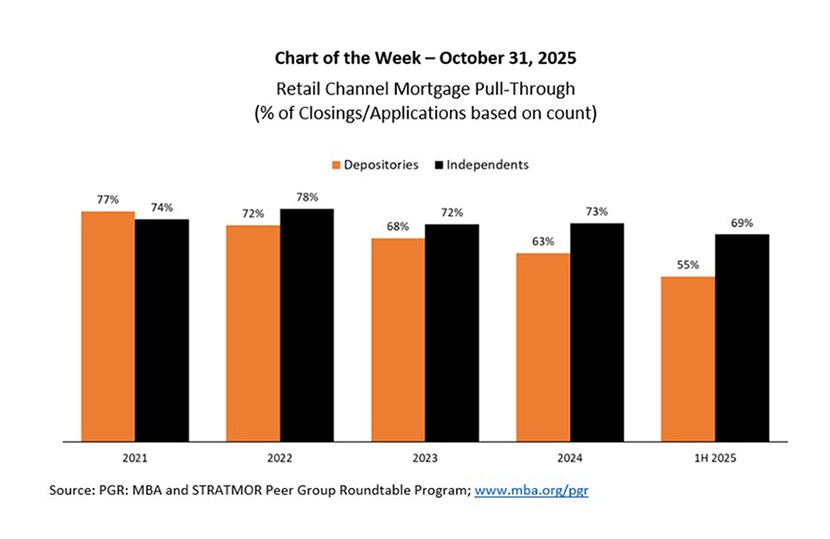

Chart of the Week: Retail Channel Mortgage Pull-Through

At last month’s MBA Annual Convention and Expo in Las Vegas, lenders discussed and debated ways to reduce origination costs and increase productivity by investing in more modern technology, refining the use of technology, and making the loan production process more efficient. Improved servicing recapture and offering a greater variety of non-agency loan products were also explored as ways to achieve scale and spread fixed costs over more origination volume.

While industry volume is forecast to increase modestly over the next three years, a key determinant of cost and productivity improvements moving forward is borrower fallout, as measured by the pull-through percentage of total loan closings to total applications in a given time period. In this Chart of the Week, data from the MBA and STRATMOR Peer Group Roundtables Program (PGR) show that pull-through in the Retail Channel declined from 2021 through the first half of 2025. For depositories, the pull-through percentage hit 55% in the first half of 2025, the lowest level reported in the PGR survey since 2000. The independents’ pull-through was generally better compared to depositories, but still dropped to 69% in the first half of 2025 – the lowest level since 2012. The data suggest that lenders are spending time, energy and money on loan applications that simply do not close. If leads and preapprovals were included along with full applications, the pull-through percentage would be even lower.

Lenders cited a variety of reasons for the recent decline in pull-through including: borrowers who took out applications with multiple lenders and ended up choosing a different lender; the difficulty of borrowers in qualifying for a loan; borrower wariness about payments once insurance, taxes, HOA and condo fees, and closing costs are factored in; sentiment regarding the future of the labor market and economy leading to second guessing their decision; concerns over the condition of the home; and confusion over the complexity of the application process. Regardless of the reason applications are not closing, mitigating borrower fallout will be a significant factor in managing operating expenses during a period of tepid originations growth.

Note: For the purposes of this analysis, only RESPA applications are reported. An application under RESPA means the submission of a borrower’s financial information in anticipation of a credit decision, which shall include the following six pieces of information: borrower’s name; borrower’s monthly income; borrower’s social security number to obtain a credit report; property address; estimate of value of the property; and loan amount.

– Marina Walsh, CMB (mwalsh@mba.org)